The financial advisor’s guide to offering retirement plans [with planning checklist]

Offering 401(k)s is no longer a niche service for financial advisors—it’s a powerful strategy for practice growth and retention. See how to get started.

Key takeaways

The retirement plan market is growing, with the micro-plan 401(k) market—those with less than $5 million in assets—expected to surge to more than 1 million plans by 2029.

57% of recordkeepers report that the majority of their plans are sold through advisors.

Offering retirement plans helps financial advisors grow revenue, deepen client relationships, and meet rising client and market demand.

With the right retirement plan partner, financial advisors can overcome common barriers to entry, such as complex compliance requirements, time-intensive administrative work, and partners who try to take business.

Betterment designed its 401(k) platform to meet the specific needs of advisors, offering a digital experience paired with dedicated human support for both advisors and their clients.

In this guide, we introduce topics such as:

- How large is the retirement plan market opportunity for advisors?

- What are the benefits for financial advisors who offer retirement plans?

- What are common roadblocks for financial advisors looking to offer retirement plans?

- How can advisors get started offering and managing 401(k) plans (with planning checklist)?

- What are the 5 key attributes to look for in a 401(k) platform partner?

How large is the retirement plan market opportunity for advisors?

Retirement plans have become a critical, expected part of modern financial planning. As business owners face state mandates and look for competitive benefits, clients increasingly expect their advisor to have a comprehensive solution for workplace retirement.

If you don't currently offer 401(k) plans, you may be missing a significant opportunity: wealth clients could look elsewhere, and potential business-owner clients may go to competitors who can provide integrated retirement solutions.

The market growth for this service is undeniable.

- Cerulli Associates expects there will be more than one million 401(k) plans by the end of the decade—an increase of 36% from 2025 to 2029.

And advisors are giving business away if they don’t offer a retirement plan.

- 57% of defined contribution recordkeepers report that the majority of their plans are sold through advisors, according to the Cerulli report.

Now is the time to ensure you have a retirement solution and a partner that can help you capture this growth.

What are the benefits for financial advisors who offer retirement plans?

Offering 401(k)s is no longer a niche service—it’s a powerful strategy for practice growth and retention.

- New revenue and retention: Retirement plans create a stable, recurring revenue stream. They also help retain wealth clients by ensuring they don’t look to competitors who offer a complete suite of services.

- Cross-selling opportunities: Plan participants are a natural source of future wealth clients. By managing both the plan and individuals’ portfolios, you create deeper, stickier, and more valuable relationships.

- Meeting client demand and state mandates: The adoption of 401(k)s, especially by small businesses, is rising (driven partly by the SECURE Act and state mandates). Offering these solutions solidifies your position as a holistic financial partner.

- Better client service: High-net-worth business owners often prefer consolidating all their finances under one trusted advisor. Referring these plans out to other providers limits your growth and can erode the overall trust in your relationship.

- Down-market growth: Small and mid-sized businesses are often underserved. Advisors who enter this space with an efficient 401(k) plan partner are poised for scalable growth.

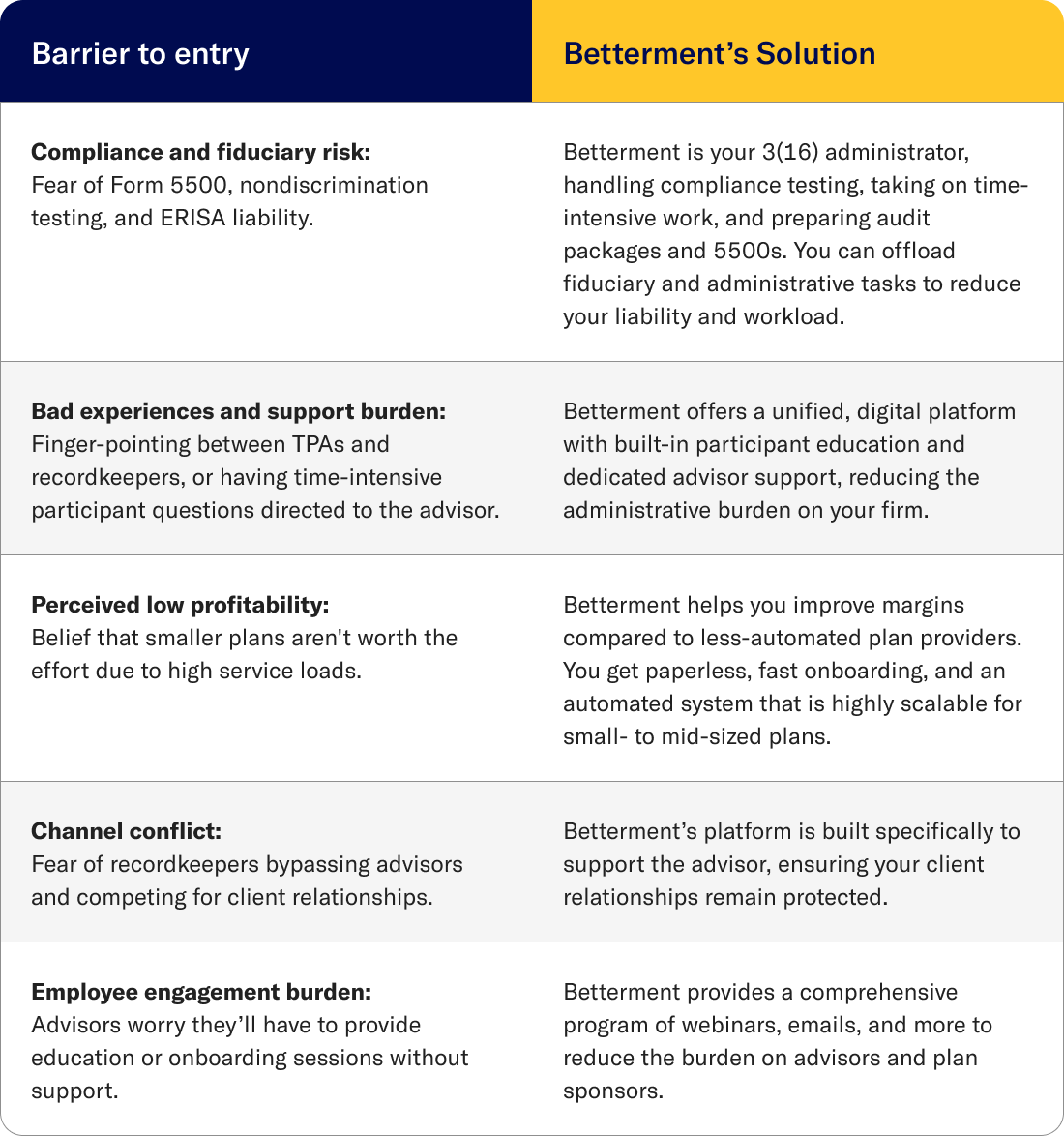

What are common roadblocks for financial advisors looking to offer retirement plans?

Many advisors hesitate to enter the retirement space due to past challenges or intimidation.

The good news? Modern, technology-forward platforms like Betterment have solved most significant pain points.

What are the steps to set up a retirement plan for your firm?

Starting can be intimidating, but we’re here to help.

Use the checklists below for each of the three steps to launch a 401(k) offering at your firm.

Step 1: Get familiar with plan basics

Before you offer a retirement plan, take the time to learn about plan types, how they work, and your role.

Checklist:

- Plan components: Learn the key components of a 401(k) plan, including plan design (eligibility, match, vesting), investment options, recordkeeping, administration, and compliance.

- Types of plans: Know the differences between plan types like safe harbor plans, Simple 401(k)s, and traditional and Roth 401(k)s.

- The role of TPAs: Explore your options for third-party administrators (TPAs) and understand the pros and cons of bundled vs. unbundled when it comes to handling plan administration and investments. (Note: At Betterment, we’re flexible and can work bundled or unbundled.)

- Your role: Understand your role as an advisor vs. a plan fiduciary. In many cases, you can offload fiduciary and administrative responsibilities to your platform partner (such as Betterment), reducing your liability and workload.

Step 2: Choose the right partner

Choosing your plan provider and tech platform might be the most important decision you make. Take the time to reflect on the following areas.

Checklist:

- Turnkey platform: Select a provider and tech platform that simplifies the process by handling recordkeeping, compliance testing, and Form 5500 filings.

- Digital onboarding: Onboarding should be paperless, fast, and intuitive. You want your clients to have a seamless experience that differentiates you from legacy providers.

- Trustworthy business partner: Ensure the partner won’t compete for your client relationships, which is important for trust and long-term growth of your offering.

- Employee engagement: By incorporating built-in participant education and a modern digital experience, you can increase adoption and directly reduce the education burden on your team.

- Scalable and competitive: The technology and process that your partner brings to the table should be designed for efficiency and automation, making it profitable even for smaller firms.

Step 3: Prospect and position

Once you select your partner, it’s time to grow your business.

Checklist:

- Prospecting process: Start with your own book. Ask existing wealth clients if their businesses offer retirement plans, or if they are considering one.

- Sales language: Make it easy for prospects to see the value you offer. Use simple positioning language like: “We offer a turnkey 401(k) solution designed for small businesses that takes the administrative burden off your plate.”

- Marketing materials: Leverage marketing resources or one-pagers from your platform partner to help explain the value to business owners.

Bonus tips: How to market to clients who own businesses

With a sea of legacy retirement plan providers in the market, you have an opportunity to differentiate on ease and support. Use these three tips to clearly communicate your value and help clients understand the pain point you solve for them.

- Highlight turnkey administration: Emphasize that providers like Betterment handle compliance, testing, and filings—removing traditional headaches.

- Showcase digital onboarding: Make it clear that plans can be launched quickly without stacks of paperwork.

- Address prior pain points directly: Acknowledge that legacy TPAs and recordkeepers have caused frustration, and explain how your model solves those issues.

Retirement is no longer an optional add-on for advisors who want to future-proof and scale their practice. Choosing the right partner can make offering a 401(k) plan a profitable and client-centric way to drive growth.

Ready to start or reconsider your retirement offering?

Contact a Betterment Advisor Solutions representative today to see a quick demo of our turnkey platform.