How-To Rollovers and transfers

Need help?

If you’re having trouble, please contact our support team at support@BettermentAdvisorSolutions.com.

We also offer dedicated transition support via our transition support team at transitions@BettermentAdvisorSolutions.com.

Taxable account transfers

Before you start a transfer, make sure you have created the appropriate account type for your client (individual, joint, or trust). Transfers generally should be like-to-like and have the same registration.

We process taxable account transfers electronically whenever possible, via the ACATS system.

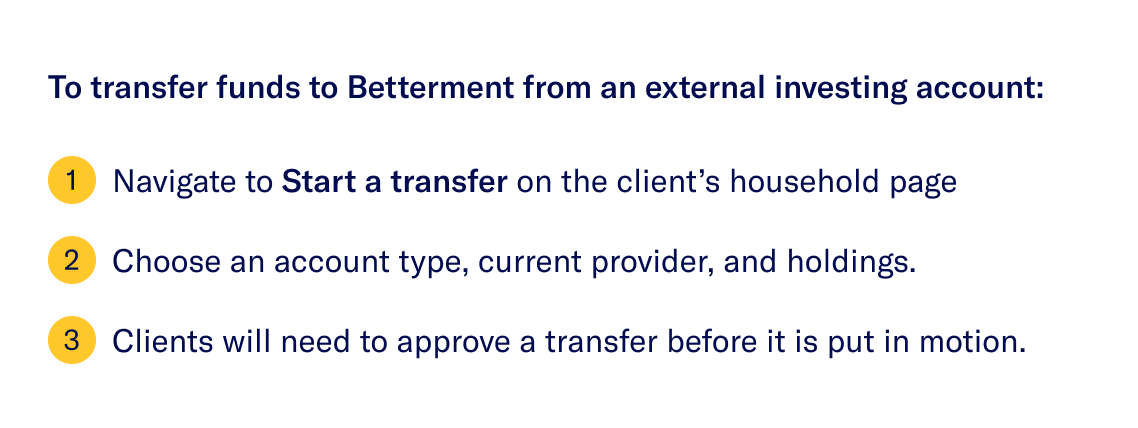

Here’s how to get started:

Go to Clients in your advisor dashboard.

![]() Select the client’s name, then Start a Transfer (in the top right corner of the screen).

Select the client’s name, then Start a Transfer (in the top right corner of the screen).

Although most institutions support ACATS transfers, not all do. If you have difficulty initiating a transfer, reach out to support@BettermentAdvisorSolutions.com, and our team can help you evaluate potential transfer options.

To learn more about ACATs transfers, please review our ACATS disclosures.

Holdings evaluation

To check if your client’s holdings are eligible for a transfer, fill out the ACATS worksheet titled “What are you transferring over?” Assets that Betterment does not support will receive an error message that we do not accept this as an in-kind transfer.

If you are trying to transfer unsupported assets, you can either:

- Liquidate the unsupported assets to cash and wait until all sales have settled to submit a full transfer, or

- Submit a partial transfer, leaving the unsupported assets in the client’s account at the original provider.

If you include an unsupported asset in your transfer to Betterment, please note that the security will be sold upon arrival to Betterment, regardless of potential tax impact (i.e.; sales of unsupported assets can result in tax impact to your client, including short-term capital gains).

After entering all tickers to be transferred, please review the “Expected trade behavior” for each one.

- Will sell: Betterment will sell certain tickers upon arrival, regardless of the account’s rebalancing settings in the account. Unsupported assets fall into this category.

- May sell: Betterment will hold or sell based on the target portfolio and rebalancing settings in the account. When constructing a custom model portfolio, you can designate certain securities as “sell only substitutes” in your client’s portfolio, and Betterment will manage them as part of a security group but will not buy additional shares of the security. To learn more, please review our sell-only substitutes one-pager and disclosures.

Cash, and cash equivalents, will be invested toward the target portfolio strategy upon arrival.

Once you’ve initiated a transfer, your client will receive an email asking them to approve the transfer. After that, the transfer will be submitted to the original provider for processing. It usually takes about 5-7 business days for providers to process transfer requests.

Individual Retirement Account (IRA) rollovers

IRA rollovers can be processed in three different ways:

Electronic direct transfer via ACATS

![]() Manual direct transfer—requires paperwork generated by Betterment and a check.

Manual direct transfer—requires paperwork generated by Betterment and a check.

![]() Indirect rollover

Indirect rollover

-

To initiate a direct transfer of an IRA via ACATS, navigate to Clients > [Client’s Name] > Start a Transfer in your dashboard.

Check that all of your client’s holdings are eligible to be transferred by entering them into the “What are you transferring over?” worksheet. If there are unsupported assets, you must either:- Liquidate the unsupported assets to cash and wait to submit a full transfer until the assets have settled, or

- Submit a partial transfer, leaving the unsupported assets in the client’s account at their original provider.

If you submit unsupported assets, you’ll receive an error message letting you know that we can only process in-kind transfers.

Once you’ve initiated a transfer, your client will receive an email asking them to approve the transfer. After that, the transfer will be submitted to the original provider for processing. It usually takes about 5–7 business days for providers to process transfer requests.Inherited IRA rollovers usually require paperwork, but our transition support team may be able to help initiate them digitally. Your client will need to provide the following:

- Name of the client’s original IRA provider

- Client’s account number with the original provider

- Confirm full or partial transfer (if partial, confirm the exact amount)

- Client’s first and last name

- Decedent’s first and last name

- Account statement (if possible)

Contact transitions@bettermentadvisorsolutions.com for help with inherited IRA transfers.

-

If an IRA is ineligible for an ACATs transfer, Betterment will automatically generate paperwork for your client to sign when you start a transfer. Your client will also receive an email, requesting their signature.

The transfer paperwork contains instructions for the original provider to mail a rollover check directly to Betterment on your client’s benefit.

Once your client has completed the paperwork, you’ll need to send it to the client’s original provider.

Check with the original provider to see how long it will take them to process and mail the rollover check to Betterment. Once we’ve processed the check, Betterment will confirm via email.

Inherited IRA rollovers usually require paperwork, but our transition support team may be able to help initiate them digitally. Your client will need to provide the following:

- Name of the client’s original IRA provider

- Client’s account number with the original provider

- Confirm full or partial transfer (if partial, confirm the exact amount)

- Client’s first and last name

- Decedent’s first and last name

- Account statement (if possible)

Contact our transitions@bettermentadvisorsolutions.com for help with inherited IRA transfers.

-

Clients can also initiate an indirect rollover into their IRA. Here’s how it works:

Contact the original IRA provider/custodian, and request a full disbursement of your client’s IRA. Ask the previous provider to not withhold any taxes from the disbursement, because they are not required to.

Your client should deposit the funds in a personal bank account linked to Betterment.

Your client should deposit the funds in a personal bank account linked to Betterment. Within 60 days, you or your client will need to deposit the exact disbursement amount into the client’s Betterment IRA via Deposit > Traditional IRA/Roth IRA > Indirect IRA Rollover.

Within 60 days, you or your client will need to deposit the exact disbursement amount into the client’s Betterment IRA via Deposit > Traditional IRA/Roth IRA > Indirect IRA Rollover.Please note: The IRS maintains certain requirements for indirect rollovers, which a client is responsible for following. Here’s a helpful IRS explainer for you to review: Rollovers of Retirement Plan and IRA Distributions.

401(k) rollovers

A 401(k) rollover into a Betterment IRA is usually completed via check. Your client must complete their current custodian’s distribution paperwork as well as some basic information from Betterment. You can generate instructions from Betterment on how the rollover check should be made payable and where it should be mailed.

Go to Start a transfer in your advisor dashboard, and generate instructions for the rollover check. There are separate instructions for rolling funds into an IRA or a Betterment 401(k).

![]() Contact the client’s current 401(k) provider to see if they have distribution paperwork your client will need to fill out.

Contact the client’s current 401(k) provider to see if they have distribution paperwork your client will need to fill out.

![]() If the original provider requires a Letter of Acceptance (LOA), you can generate one in your advisor dashboard, under Documents.

If the original provider requires a Letter of Acceptance (LOA), you can generate one in your advisor dashboard, under Documents.

Other employer plan rollovers

Employer-sponsored plans, such as a 403(b), 401(a), pension plans, or Thrift Savings Plans (TSP), are usually ineligible for ACATS transfers. Your client will need to complete their current provider’s transfer paperwork. Then the provider will mail the rollover check to Betterment.

For more information on this process, click on Start a Transfer > “Other Employer Plans.”

Additional guidelines and procedures

-

Original providers can send rollover checks to two different addresses.

These addresses are only for IRA rollover checks from other custodians; Betterment cannot accept check deposits directly from client bank accounts.

Standard mail

Betterment

PO Box 203945

Dallas, TX 75320

Overnight or signature-required mail

Lockbox Services #203945

Betterment

2975 Regent Blvd., Suite 100

Irving, TX 75063

There are separate addresses for rollovers into Betterment 401(k) accounts (including solo 401(k)s).

Standard mail

Betterment 401(k)

PO Box 208435

Dallas, TX 75320-8435

Overnight or signature-required mail

Lockbox Services 208435

Betterment 401(k)

2975 Regent Blvd., Suite 100

Irving, TX 75063

Rollover checks can take up to 3 weeks to appear in a client’s account. The client will receive an email, notifying them that we have deposited their rollover check. -

Betterment generates a 10-digit tracking number that starts with “BMT” for all rollovers. This is different from the client’s 15-digit legal account number and is tied to a specific rollover request. We do this to reduce the number of times Betterment has to share the client’s legal account number with a third party.

-

Sometimes the original provider requires Betterment to fill out sections on behalf of your client. If that’s the case, please have your client complete all other sections—including their signature—before sharing the document with our support team.

Rollover paperwork takes about 1-3 business days to be completed. We’ll return it to you with a secure link, via email. -

You can view the status of ACATS transfers in Co-pilot.

Pending ACATS

These clients have outstanding ACATS transfers that have been approved by the client and are waiting for approval or rejection by the original provider. You can view details and/or dismiss transfers from the list.

Failed ACATS

The clients listed here have failed ACATS transfers that you may want to follow up on. You can view details about each failed transfer or delete them.

ACATS Approvals

This shows transfers that you have initiated on behalf of your clients. You can send a reminder to clients to approve their transfers. Until the client takes action, these will not be submitted to the original provider. -

In general, most outbound transfers are initiated at the institution receiving the funds. To get started, you or the client should contact the receiving institution and ask to initiate an electronic in-kind ACATS transfer.

The receiving institution may need your client’s account statements from Betterment as well as the account number(s) for those they intend to transfer. Here’s where you can find that information:- Monthly statements: To download your client’s monthly statement, which also includes account numbers, log in as the client and navigate to Documents.

- Account number: Account numbers are listed on monthly statements, or by selecting Settings > Accounts.

Betterment works with Apex Clearing to process outbound transfers. If “Betterment” is not listed as an ACATS option, select “Apex” as the originating account institution.

Generally, outbound ACATS transfers are completed in 5–7 business days following receipt and approval. While the transfer is being processed, the client’s account will be temporarily locked. See our ACATS Terms & Conditions for more information.

Please note that electronic in-kind ACATS transfers are not supported for all transfers. If the receiving firm is unable to fulfill an ACATS request or if ACATS is otherwise unavailable, please check out this article for next steps.

Please note that Betterment Securities charges a flat fee of $75 for each investing account transfer to another company (outbound transfer).

Get support you can count on

Contact our team:

support@BettermentAdvisorSolutions.com

(888) 646-2581 Monday–Friday, 10am–6pm ET