onboarding Explore your

new advisor dashboard

Summary

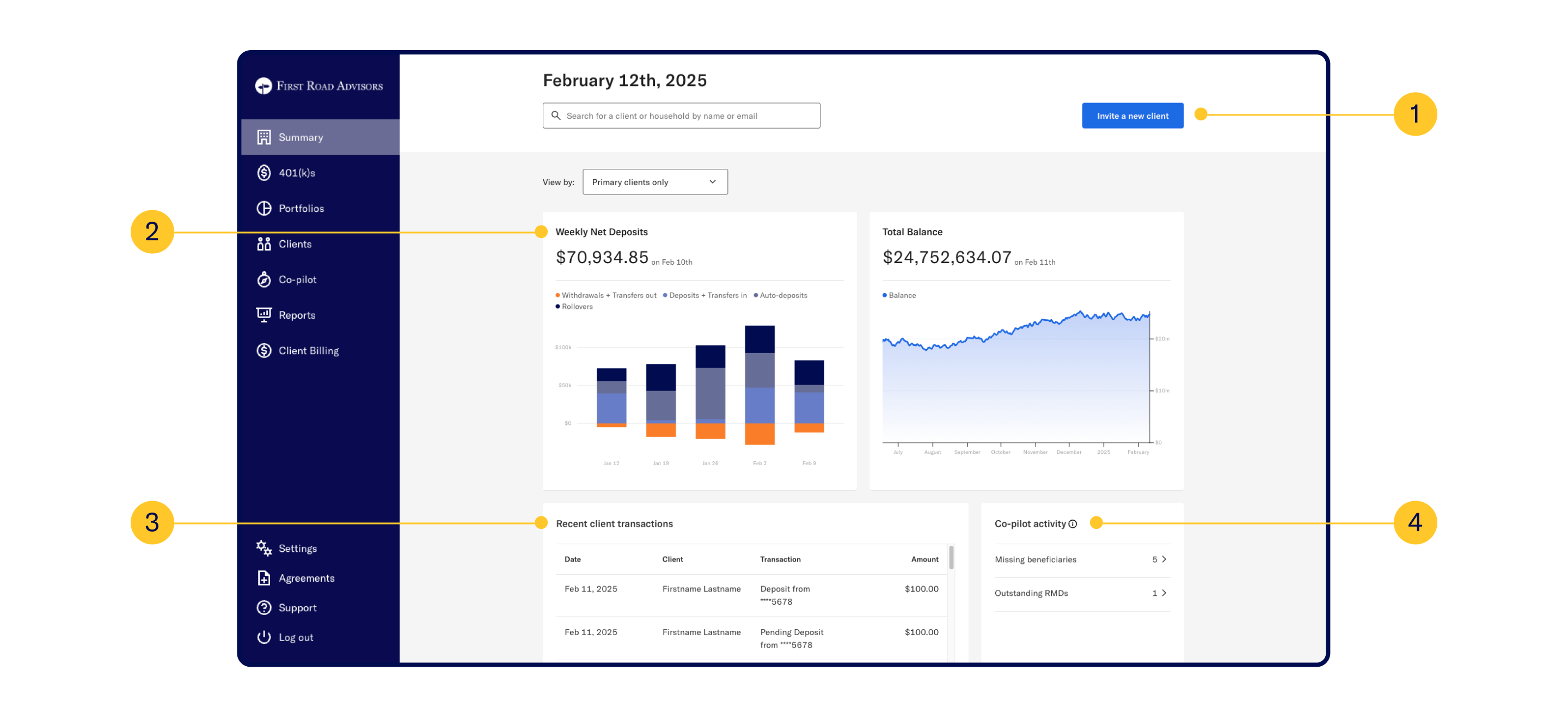

Invite clients

Invite clients

See Client Invitation Process for more information.

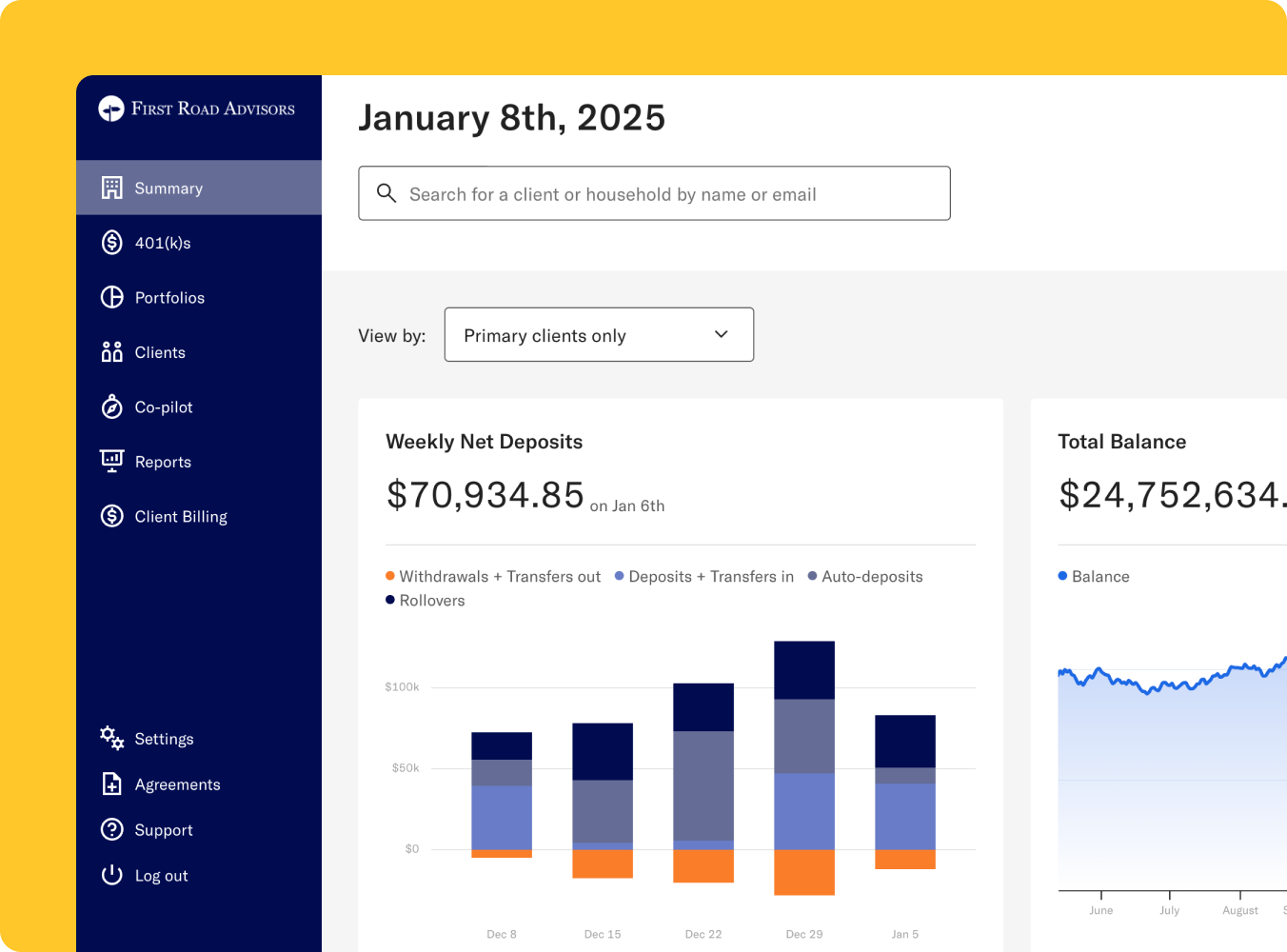

Weekly net deposits and total balance

Weekly net deposits and total balance

Monitor your client’s weekly net deposits. You’ll also see a graph that tracks the total invested balance over time. You can filter the graph to show only primary clients vs. all clients.

Recent client transactions

Recent client transactions

Click to see all client activity, with additional filters and options, including a CSV file that you can download.

Co-pilot activity

Co-pilot activity

Co-pilot aggregates client actions that you may need to review. Through Co-pilot, you can nudge clients who need to complete tasks by sending them email reminders. Visit Co-pilot in your dashboard for more information.

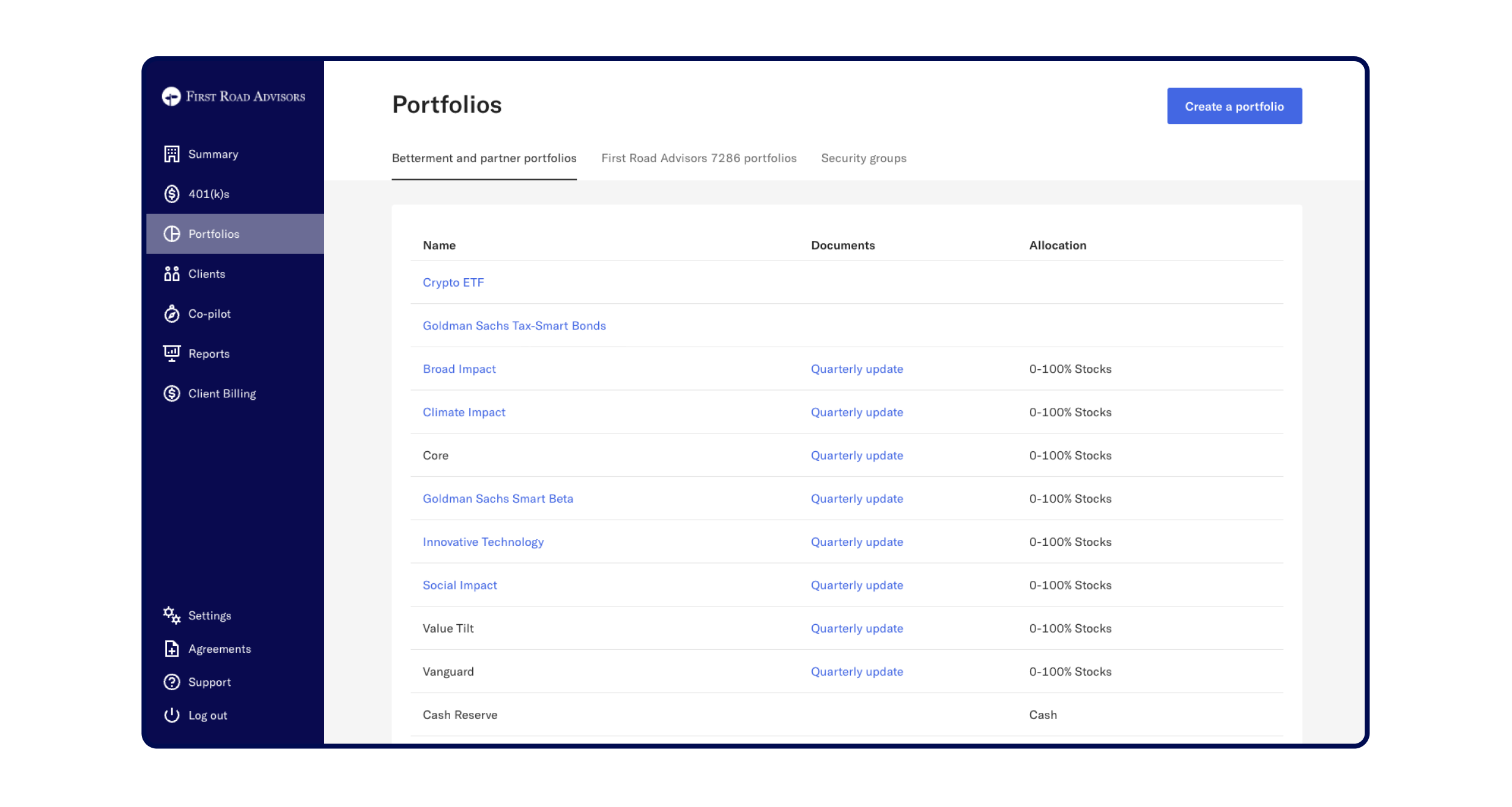

Portfolios

Firm admins can create or edit custom model portfolios for their firm. You can find more details about our turnkey and customizable options in Portfolios and Features, and explore all portfolio options.

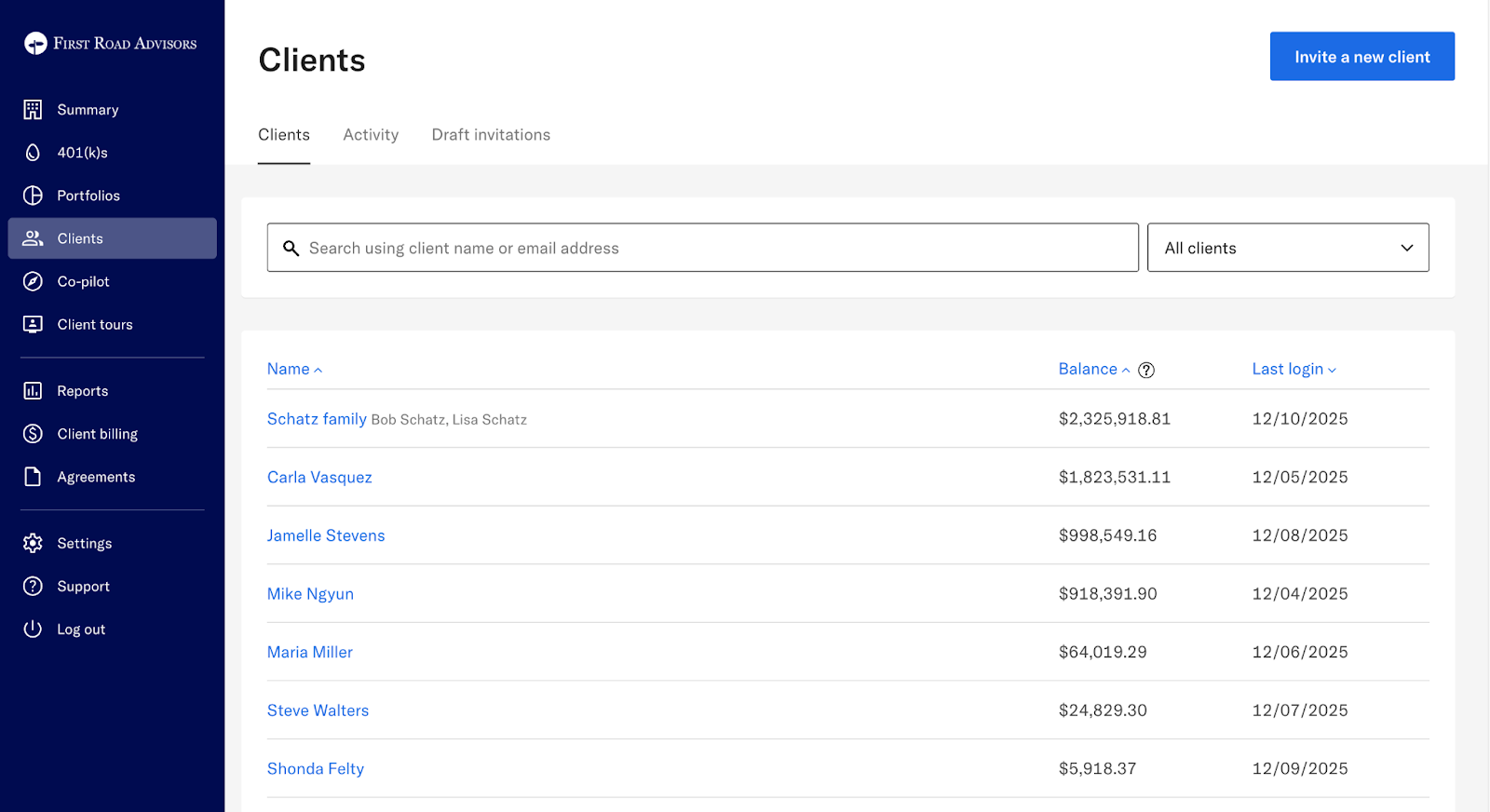

Clients

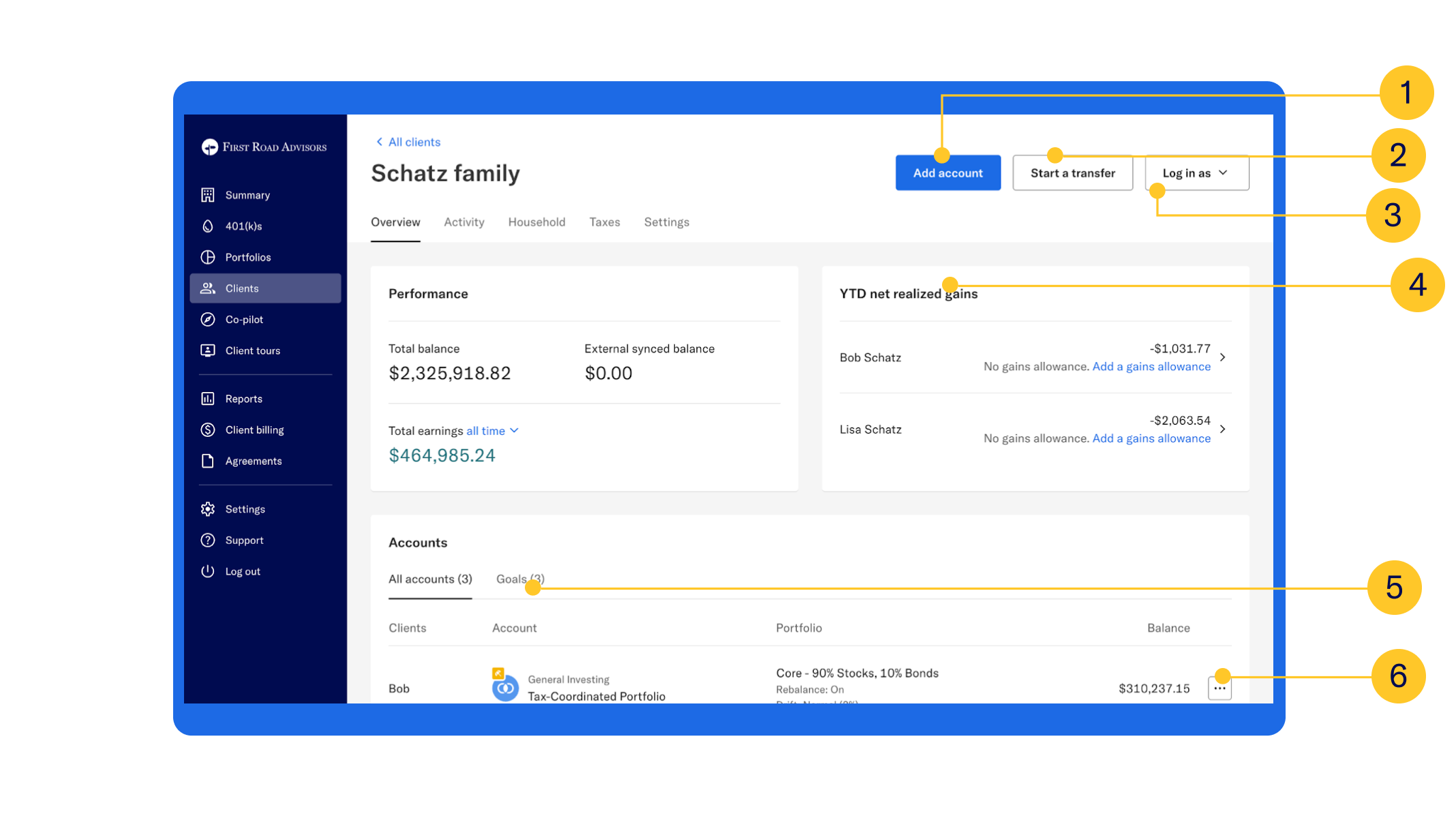

clients Overview

Add account

Add account

Add another account or goal for an existing client.

Start a transfer

Start a transfer

Initiate an ACATS transfer or a direct rollover from an external account into Betterment. More details about transfer logistics are in Rollovers and Transfers.

Log in as a client

Log in as a client

See what your client sees when they sign on to Betterment. Certain actions can only be taken while logged in as the client.

Tax management

View net-realized gains and losses, and set an annual gains allowance. More details can be found on our Portfolio Management page.

Filter your view

Choose to view accounts by “All accounts” or by “Goals” to access insights how you prefer. An account holds client investments, while a goal is an optional financial planning feature that adds personalization to how accounts are managed.

Actions and settings

1. Within each account, you’ll find three Actions dots with a menu where you can do the following:

- Go to account

- Edit portfolio

- Edit goal details

- Rebalance account

- Edit rebalance settings

- Deposit

- Withdraw

2. For those with a traditional IRA, you can perform a Roth conversion.

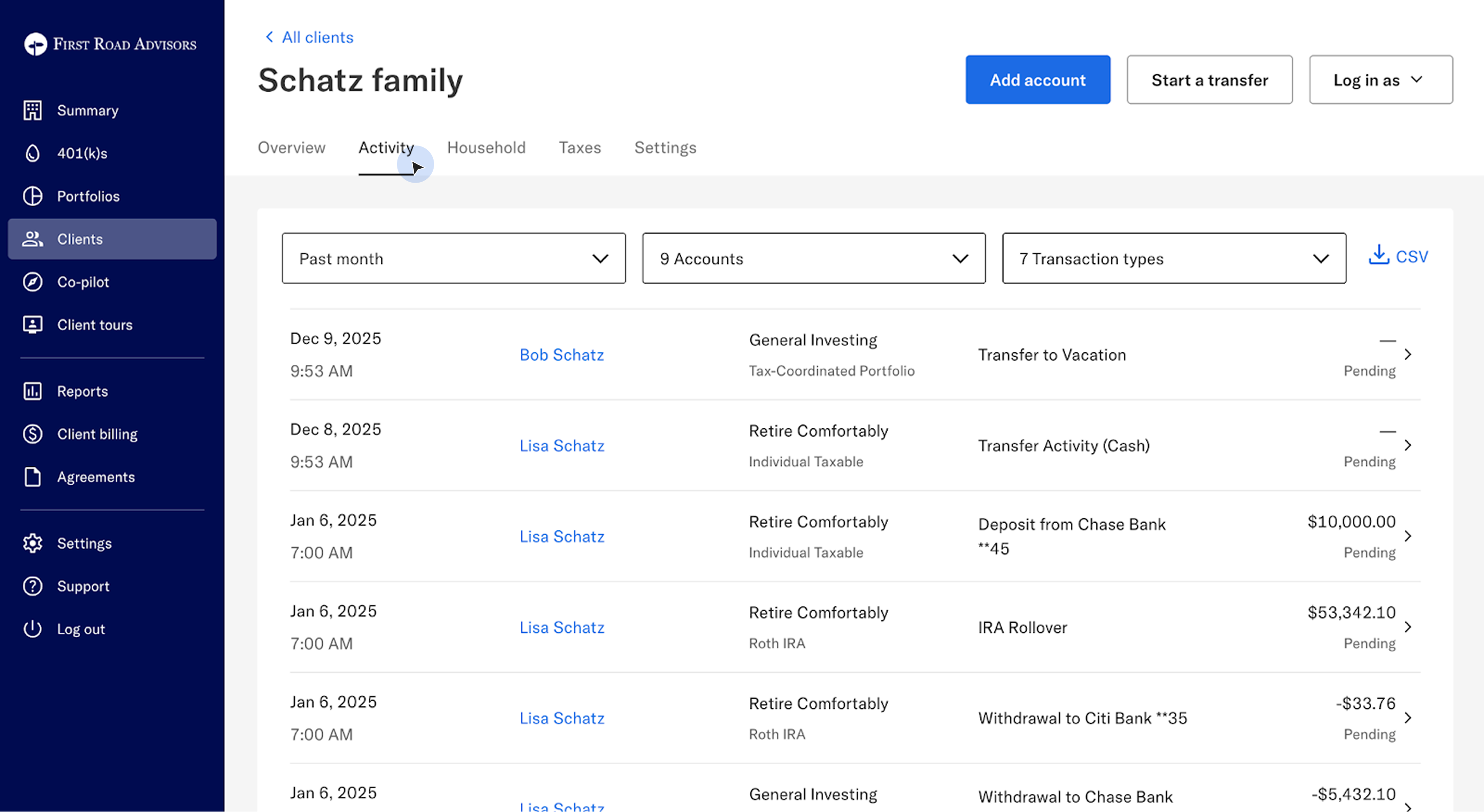

Activity Household

Explore the Activity dashboard to access client insights on trading activity, deposits, withdrawals, fee billing, and more.

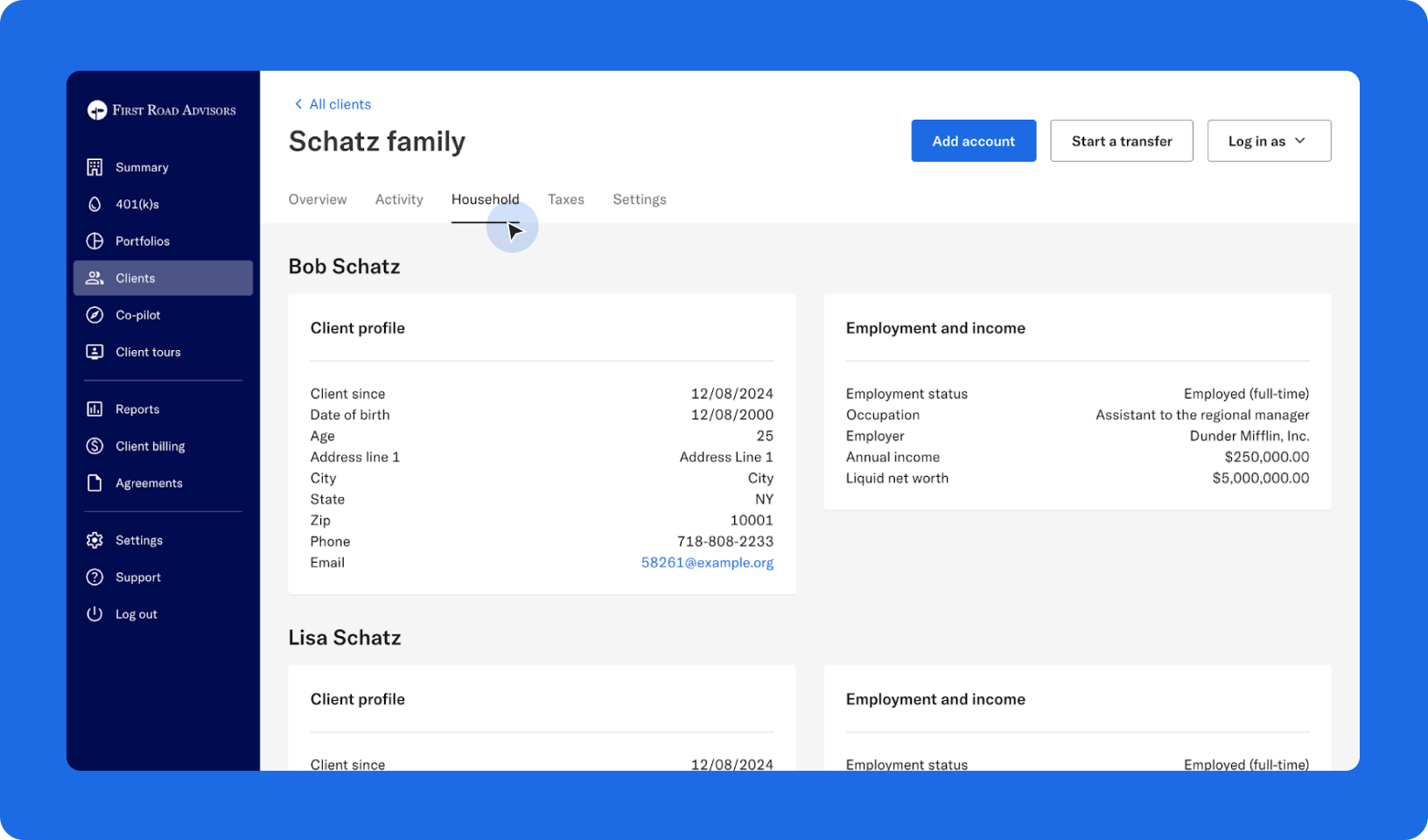

clients Household

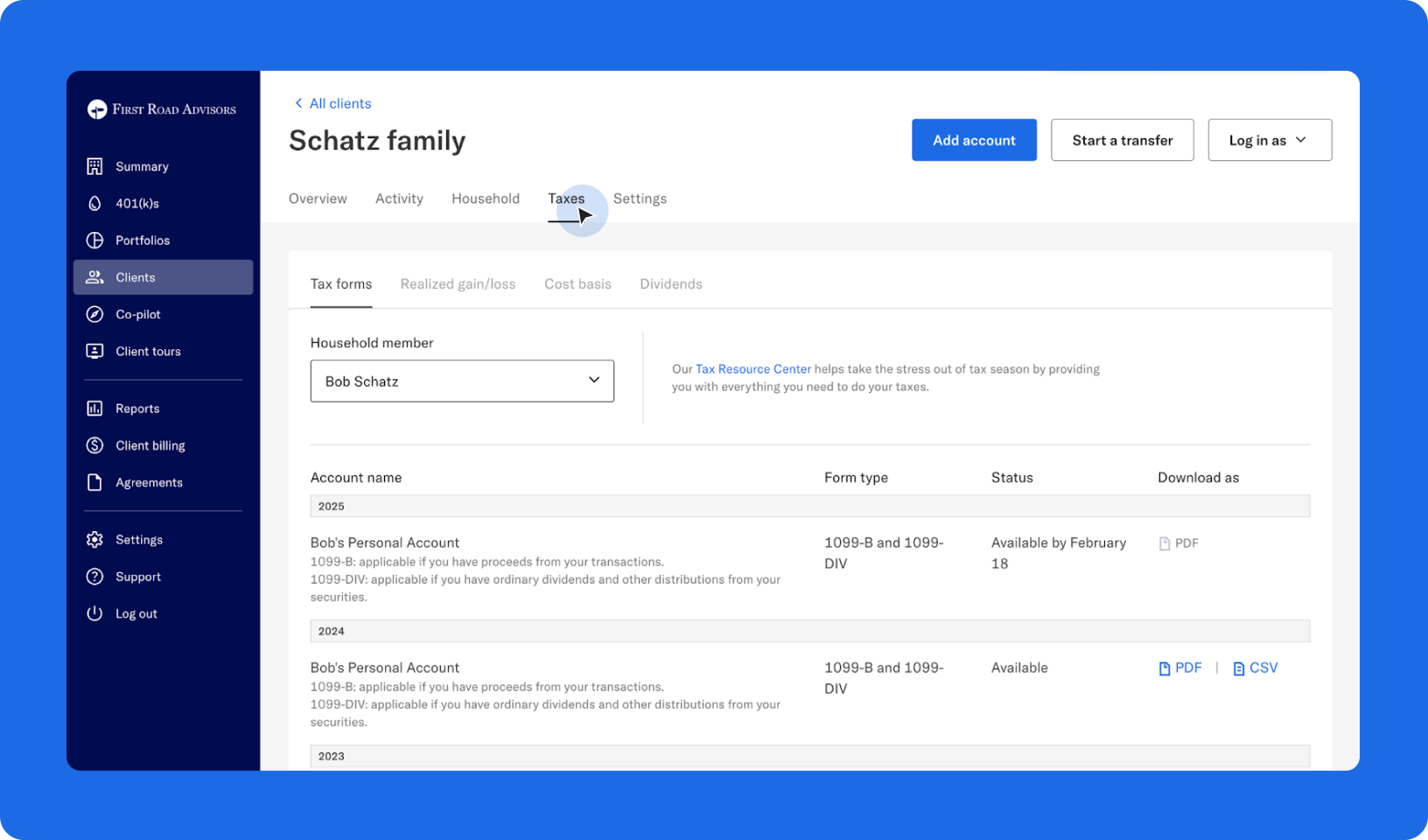

clients Taxes

Within each account, you can access the following:

Official tax forms

Realized gains/losses for this calendar year—this should not be used to file taxes. It contains information about the gains and losses realized as a result of the sale of securities within the account.

Cost basis (unrealized gain/loss) of current account holdings—this should also not be used to file. It contains information about the current holdings of the account.

Dividends received for the current and past calendar years—this should not be used to file client taxes.

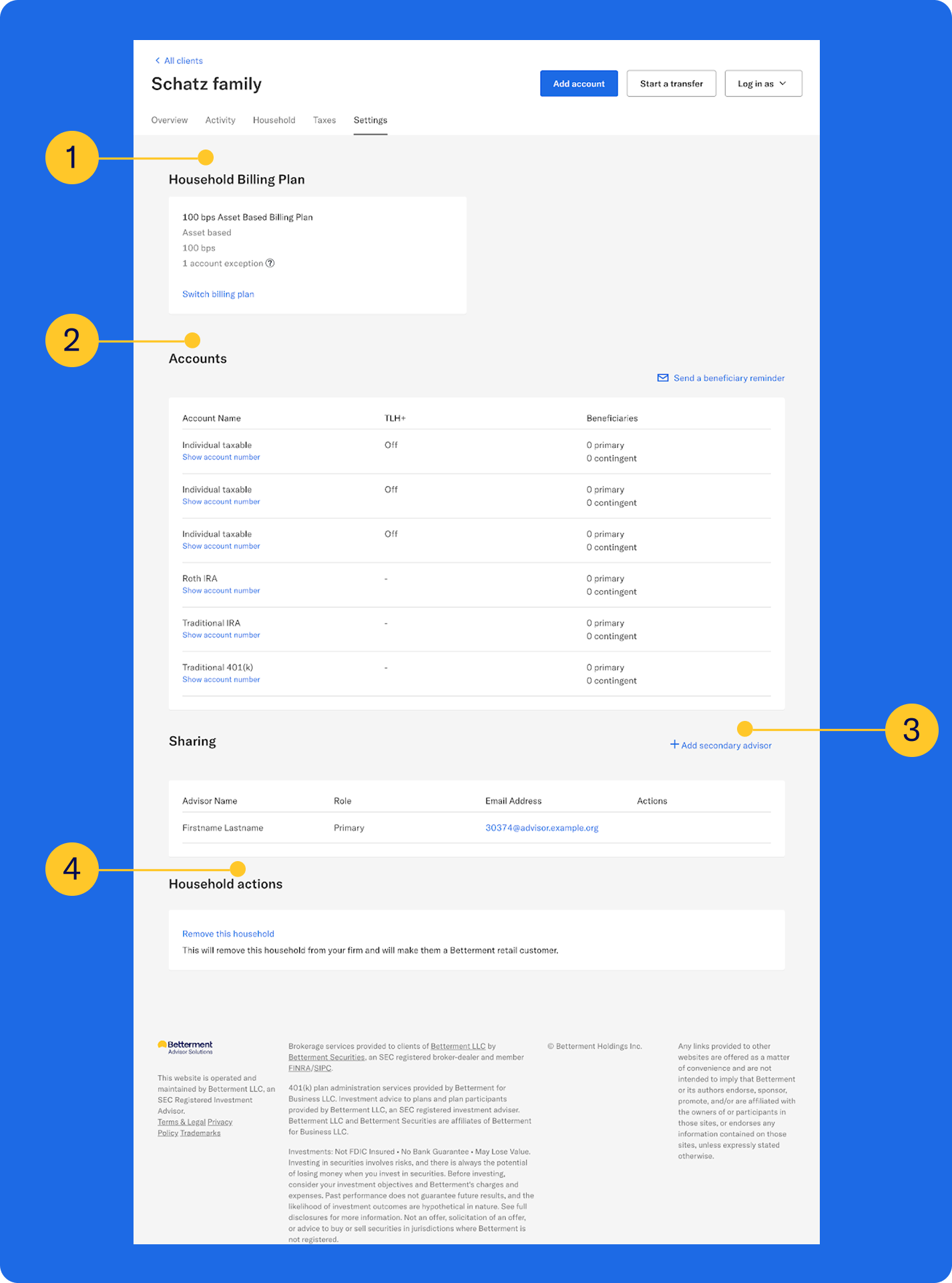

clients Settings

Billing

Billing

Review or adjust the client household's billing plan.

Account information

Account information

- See the legal account types for all accounts under the client’s profile.

- View account number(s) for a transfer, rollover, or other purposes.

- Tax-loss harvesting status: You can turn it on/off and find more information about it here.

- Beneficiary status: Clients can set beneficiaries under Settings > Accounts; this cannot be edited from the advisor dashboard.

Secondary advisors

Secondary advisors

Add or remove secondary advisors.

Remove from firm

Delete a client from your firm account, and move their account to Betterment’s Retail platform. The client will retain access to their Betterment account, all extant legal accounts will remain open, and funds will remain in their portfolio strategies. You and your firm will no longer have access to their account.

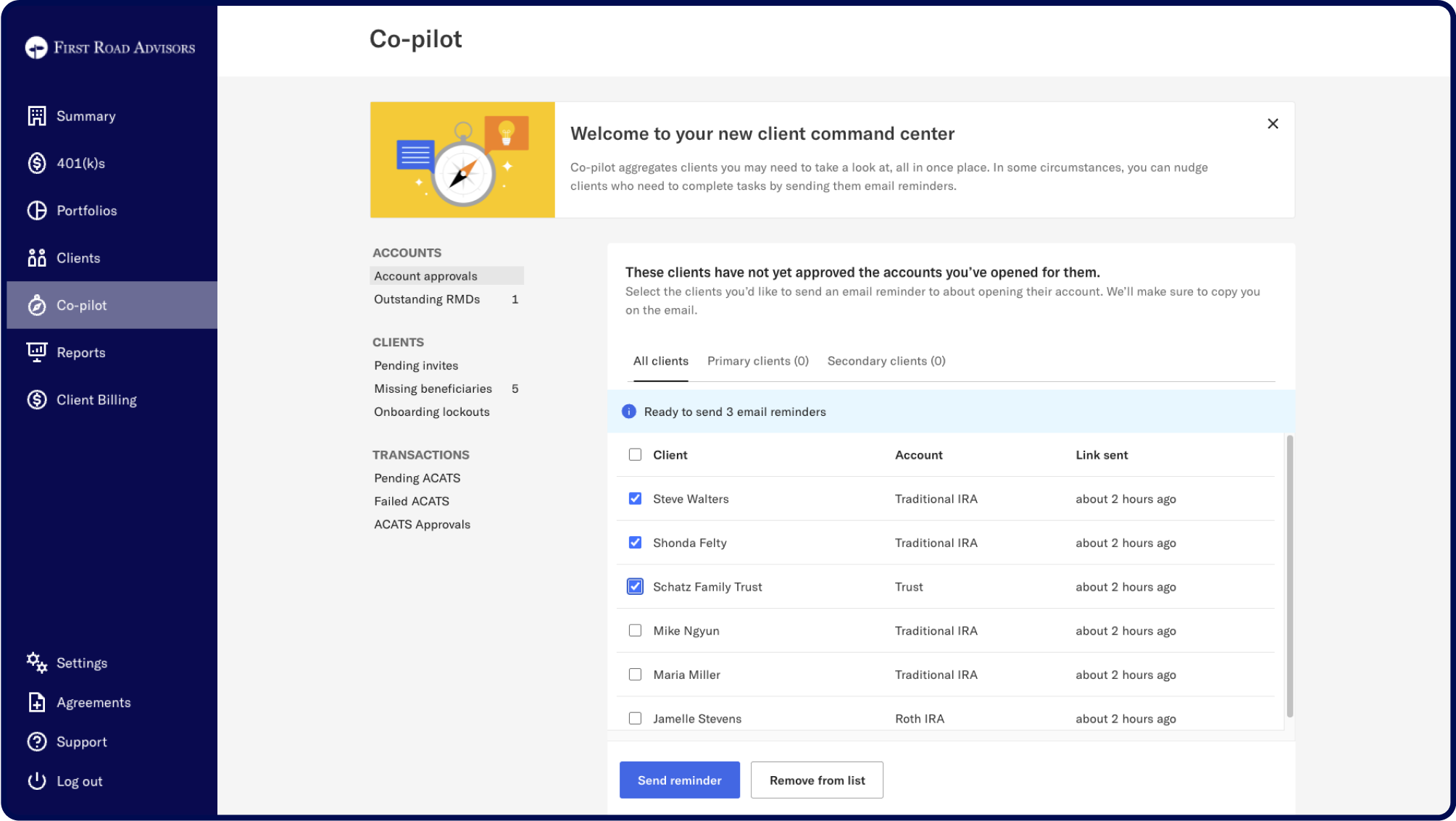

Co-pilot

Accounts

Accounts

Account approvals

Any additional accounts you have initiated opening on behalf of a client that have not yet been approved/opened by the client.

Outstanding RMDs

Any required minimum distributions for clients with traditional IRAs who have not yet withdrawn funds.

Clients

Clients

Pending invites

Invitations to new clients that have not been accepted.

Missing beneficiaries

Accounts with no designated beneficiaries. You can automatically send reminder emails, so your clients can easily choose beneficiaries.

Onboarding lockouts

For clients who are currently locked out of their accounts and may need to upload additional identification documentation to verify their accounts. View account statuses, resend document upload instructions, upload documents on behalf of your clients, or remove clients from the list.

Transactions

Transactions

Pending ACATS

ACATS transfers that have been approved by the client and are waiting for approval or rejection by the contrafirm.

Failed ACATS

ACATS transfers that have not been successful. The reason for the failure is included with troubleshooting instructions.

ACATS approvals

ACATS transfers waiting for a client action to be submitted to the original firm.

Firm admins only

Reports

This part of the dashboard contains fee statements detailing the accrued client fees paid out to your firm. They are downloadable in PDF and CSV format.

You can view Fee statements and Fee accrual reports to download a detailed breakdown of client fees accrued daily, within a billing period.

For other report options, such as account lists, client contact information, and trade blotters, please contact support@BettermentAdvisorSolutions.com.

Only firm admins can access. If you need information from this section, please contact your firm admin.

Compliance access only

Compliance

This section provides read-only access to all of the firm’s households. If your firm has opted into the Client Agreement Automation process, you can view client agreements and time stamps via the Agreements tab.

Only advisors with Compliance access can view. If you need this information from this section, please contact a member of your firm with Compliance access or your firm admin.

Firm admins only

Client billing

Review all fee plans that you can assign to clients. These plans can be edited or set as the firm’s default setting. The default fee plan is automatically assigned to new households when they set up an account. You can also create new billing plans. For more billing information, check out this article.

Only firm admins can access. If you need information from this section, please contact your firm admin.

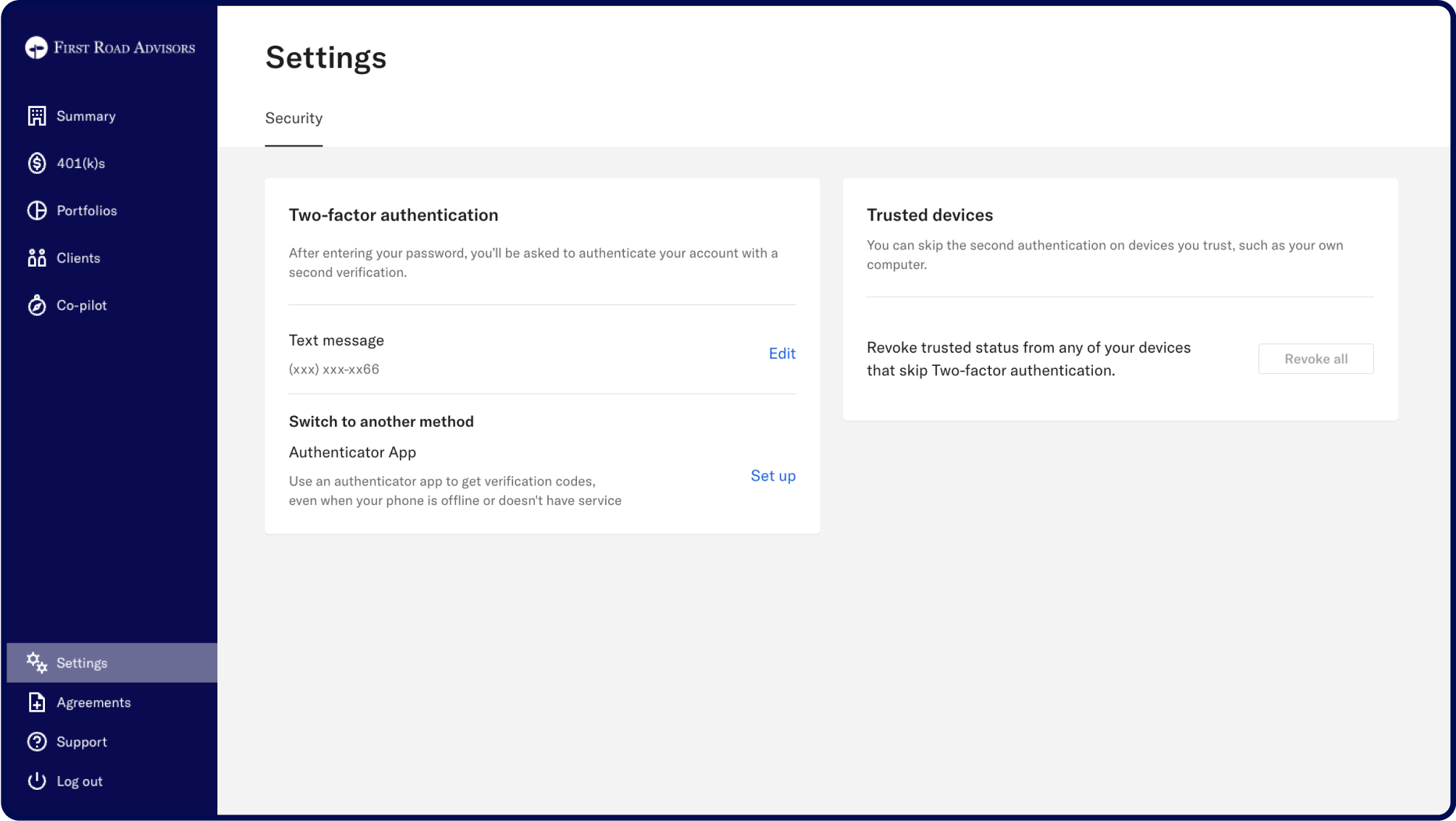

Settings

Manage two-factor authentication and trusted devices. Firm admins can manage key firm details, including contact info, billing, and fees.

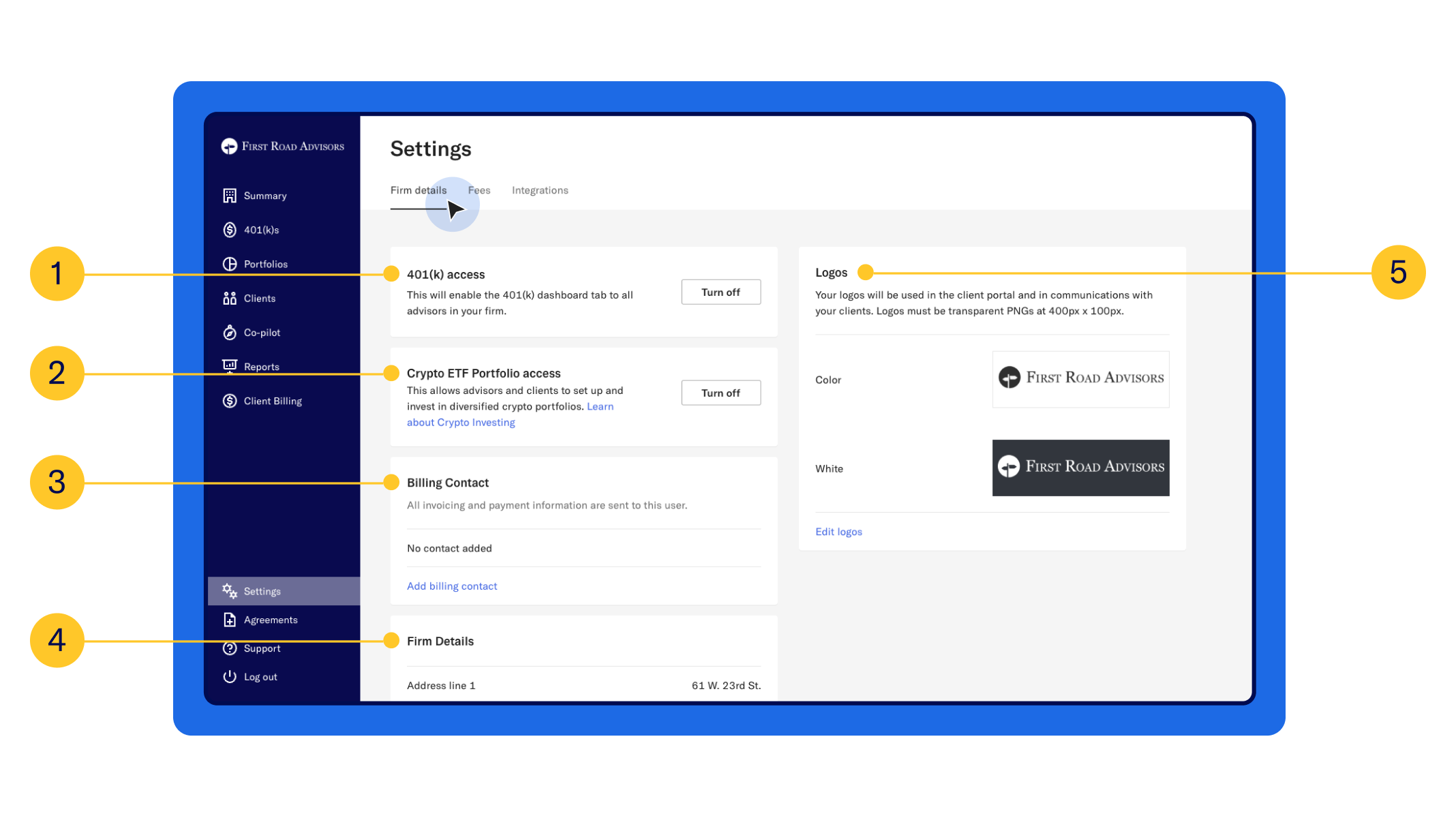

Firm admins only

Settings Firm details

401(k) access

401(k) access

For advised 401(k)s, this enables or disables access to the 401(k) tab in the advisor dashboard, for all advisors at the firm. For more information, please see this page.

Crypto investing access

Crypto investing access

Here, you can enable or disable crypto investing for all advisors at your firm. Betterment also offers a Bitcoin and Ethereum ETF portfolio, which you can learn more about here.

Billing contact

Billing contact

Your firm’s billing contact will receive all invoices, payment receipts, and information. This can be edited in Settings. If no billing contact is entered, invoices will be sent to the firm admin.

Firm details

Firm details

This is where you find/update the firm's address.

Logos

Logos

Add/update your firm’s logo. Logos must be exactly 400x100 pixels in PNG file format in order to be uploaded.

Firm admins only

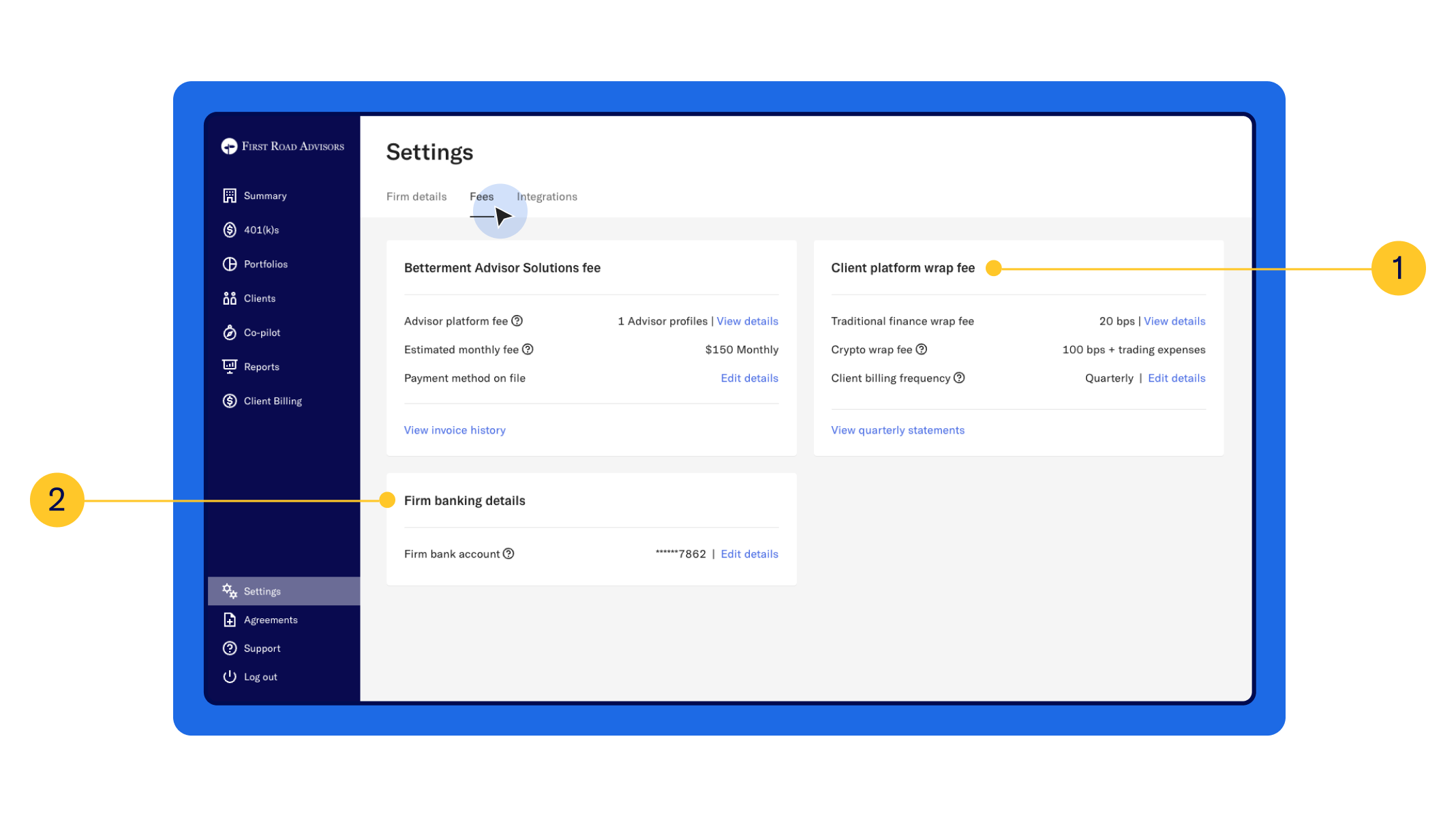

Settings Fees

Client platform wrap fee

Client platform wrap fee

Betterment charges your clients a bps wrap fee. Firm admins can change the client billing frequency between monthly and quarterly here, as well.

Firm banking details

Firm banking details

This is the bank account where Betterment will send the advisory fees we collect from your clients. Firm admins can update this account at any time.

Firm admins only

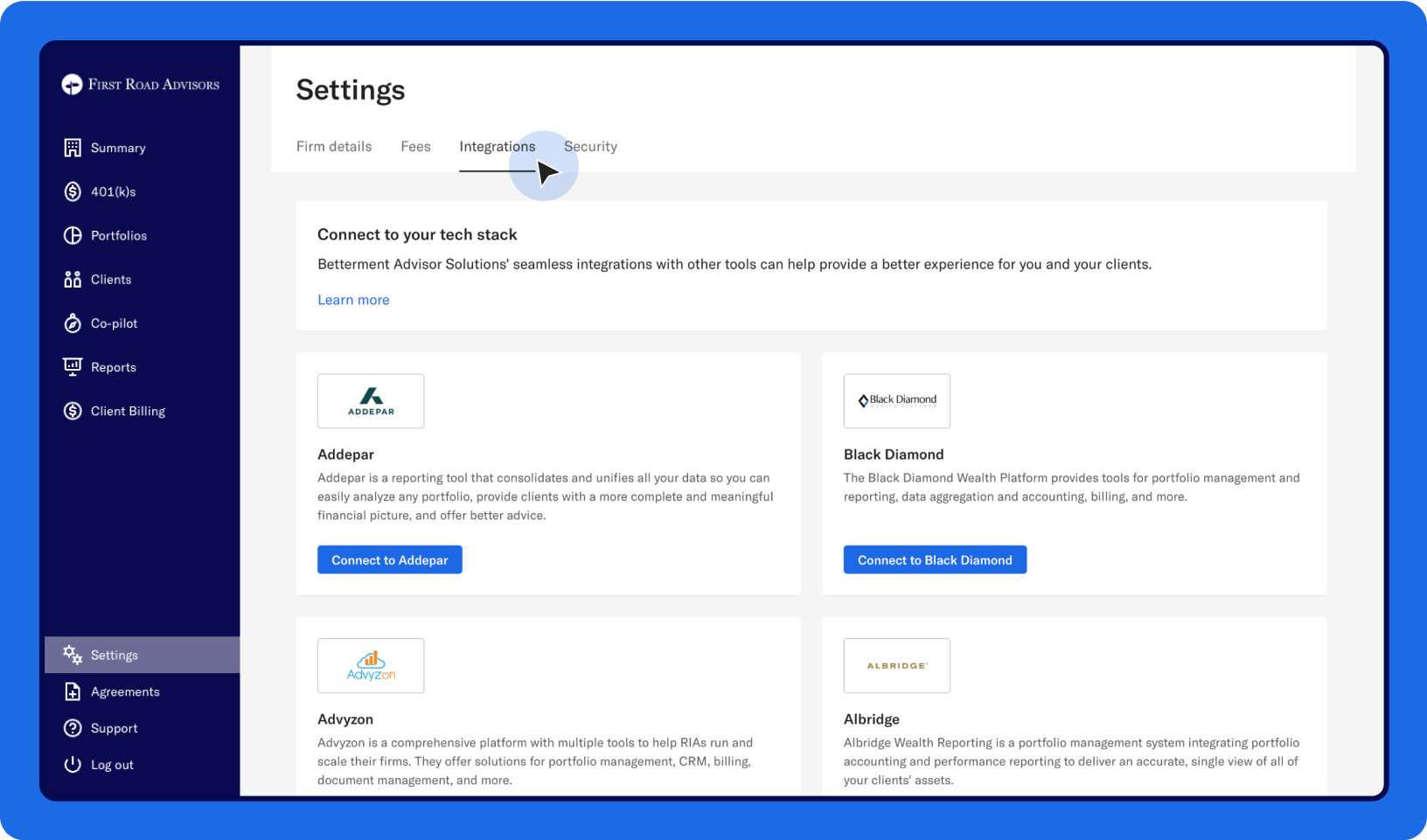

Settings Integrations

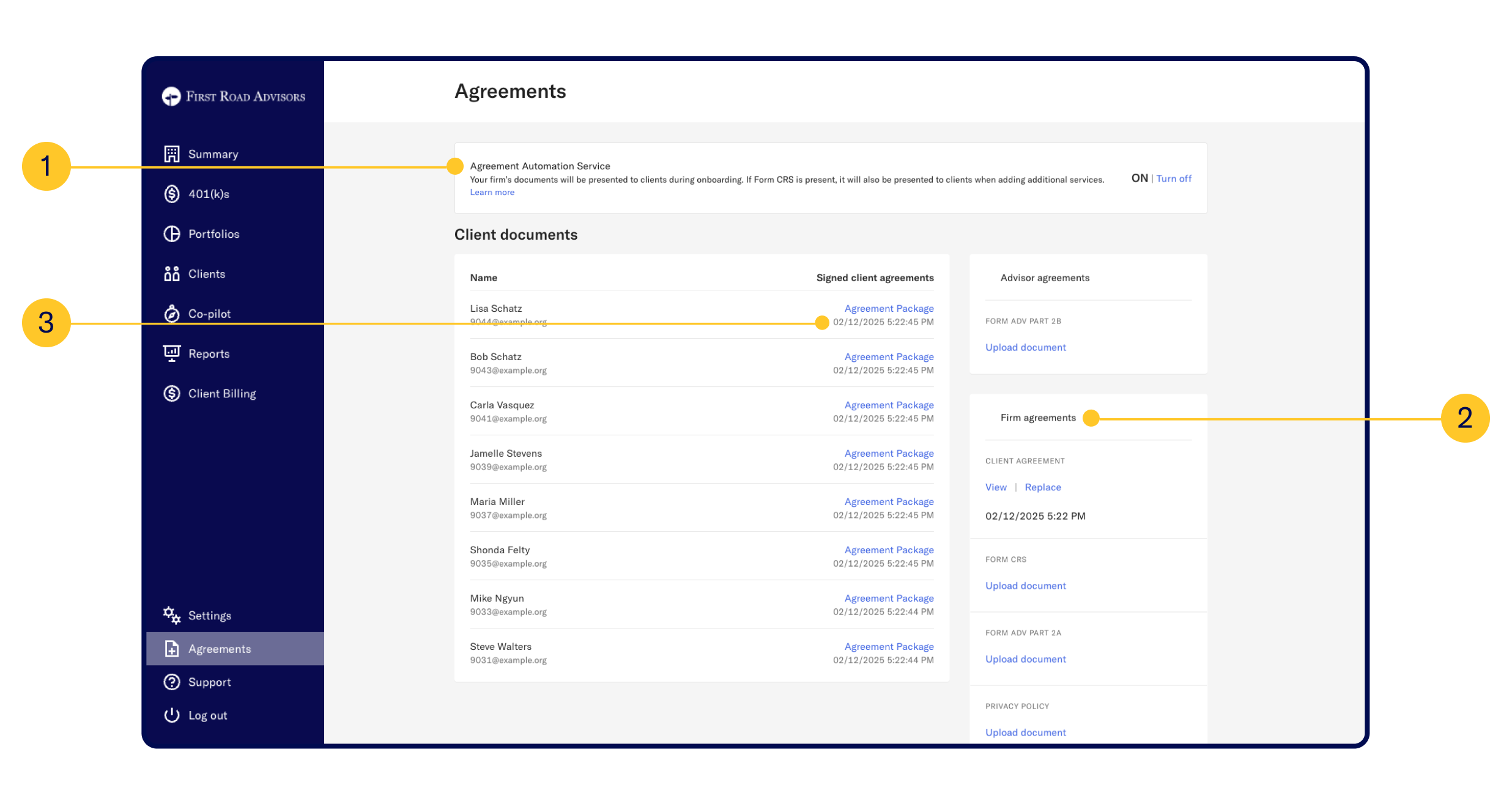

Firm admins only Agreements

Only firm admins can access this section.

Agreement Automation Service

Agreement Automation Service

Toggle Agreement Automation Service on and off (more information here).

Upload or replace firm-level agreements

Upload or replace firm-level agreements

- Client agreement

- Form CRS

- Form ADV Part 2A

- Privacy policy

- Form ADV Part 2B: By clicking “Replace,” you can upload your Form ADV Part 2B. Please note, the Form ADV Part 2B is specific to each primary advisor. If your firm has multiple primary advisors and you would like all of the Form ADV Part 2Bs to be included in the onboarding package, please upload them as part of the Form ADV Part 2A.

Agreement time stamps

Agreement time stamps

Our automated agreement function makes onboarding new clients fast, easy, and paperless. You can learn more about how this process works here.

With this automated process, your firm provides a client agreement, Form ADV, and privacy policy to Betterment, which we will then host on our platform. As part of the client sign-up process, Betterment will electronically deliver these documents to clients and permit clients to electronically consent to all documents in your firm’s agreement package. Clients will also sign an agreement with Betterment as a sub-advisor on their accounts. The most recent version of the Betterment Advisor Solutions Advised Client Agreement can be found here.

Please note: We do not collect traditional, handwritten signatures for either your agreements or the Betterment Advisor Solutions sub-advisor agreements; consent is indicated electronically.

Betterment provides a time stamp of the electronic consent in lieu of signed, paper forms. The exact date and time that a client consented to the firm's advisory agreement is available here in the Agreements tab of the advisor dashboard. Reports with these signatures can also be provided upon request by the Advisor Support Team for audit purposes.

Get support you can count on

Contact our team:

support@BettermentAdvisorSolutions.com

(888) 646-2581 Monday–Friday, 9am–6pm ET