onboarding Explore your

new advisor dashboard

Profile setup

To register your firm and set up your advisor profile, you’ll need a unique link, provided by your Relationship Manager. To create an account under an existing firm on our platform, email your firm administrator and our team at support@BettermentAdvisorSolutions.com. Keep in mind, your firm admin may need to provide authorization to activate your account.

Login

After your profile is up and running, you can sign in through the login portal. We recommend bookmarking this page, so it’s easy to find. If you need to reset your password, select Forgot your password? from the login page. For security, all advisor profiles require two-factor authentication.

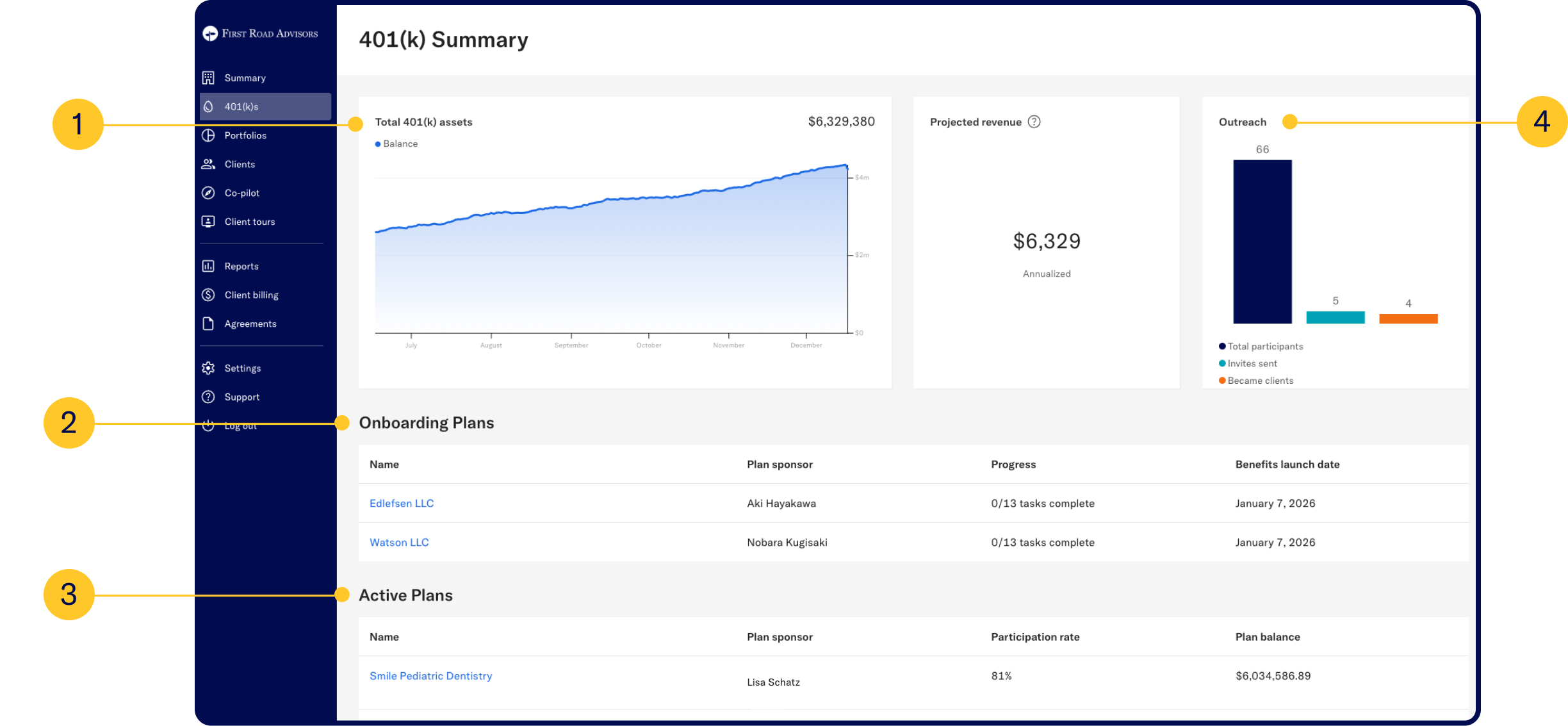

Summary

Total balance

Total balance

Monitor your plans’ total assets. You’ll also see a graph that tracks the total invested balance over time.

Onboarding tracking

Onboarding tracking

Track your clients’ onboarding progress. Get a detailed breakdown of tasks and deadlines to ensure a smooth process.

Funded plans

Funded plans

View all of the plans you are currently managing, with plan balance, participation rate, and plan manager information.

Client outreach

Client outreach

If you also manage wealth clients through Betterment, you can see invitations you have sent to clients for wealth management services, as well.

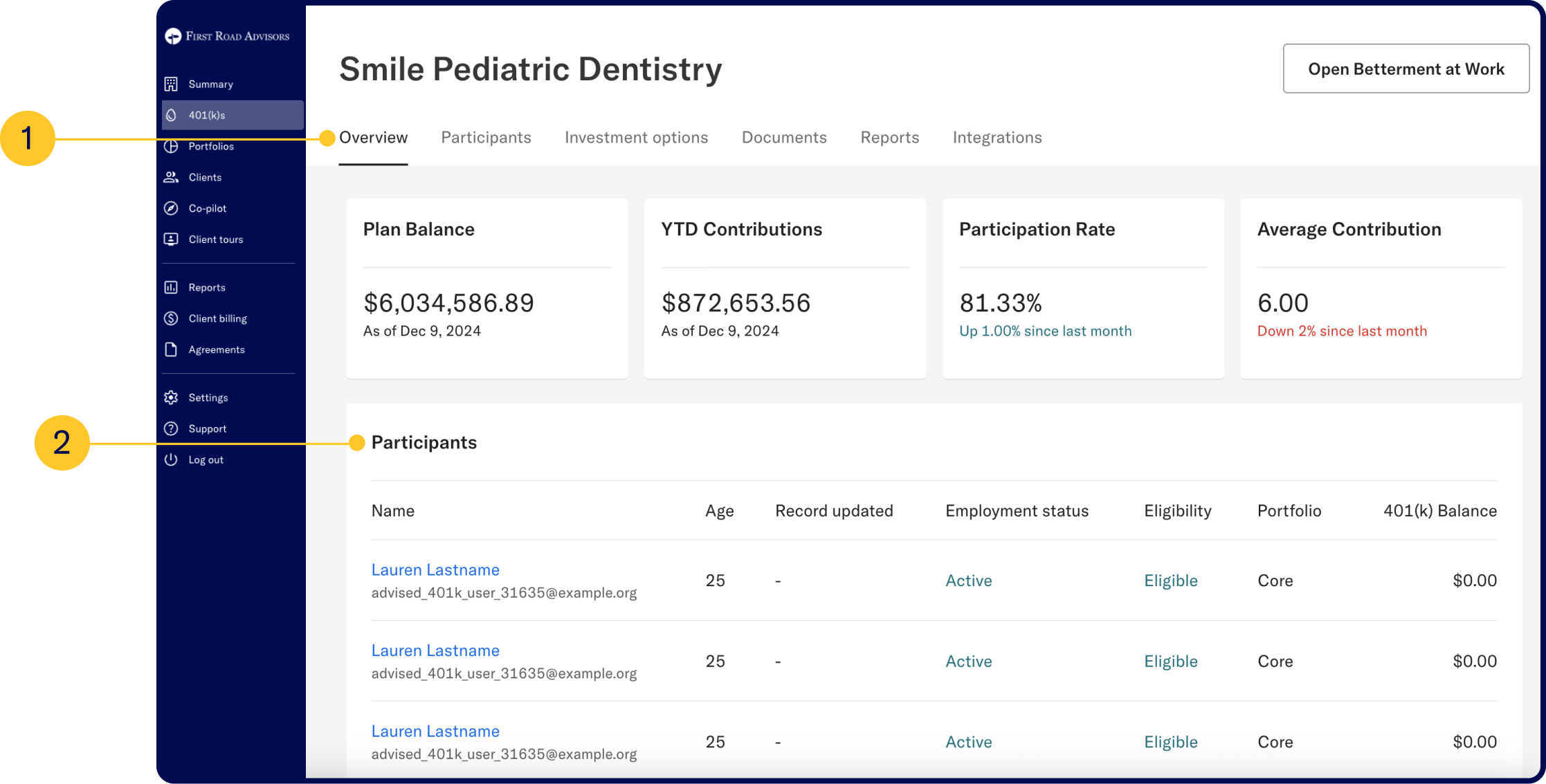

Plans

Access the plan balance, YTD contributions, and track month-over-month participation rates and average contributions.

Images are hypothetical.

Plan overview

Plan overview

See a snapshot of your plan’s performance, from total assets and contributions to participation trends.

Participants

Participants

See who’s in the plan, check eligibility, and monitor participation.

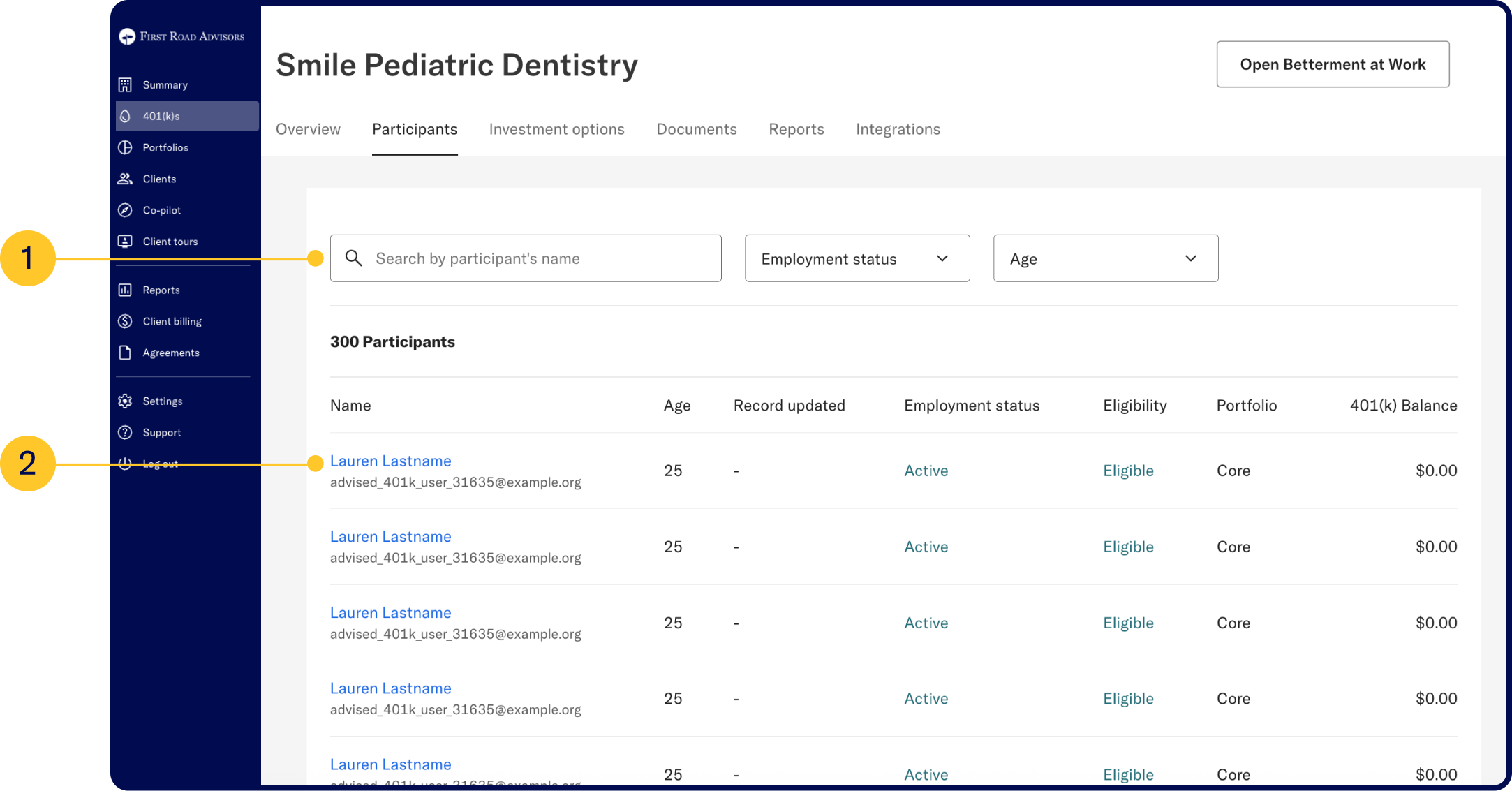

Plan participants

Get a detailed view of everyone enrolled in the 401(k) plan, including their eligibility status, employment status, account balance, and investment strategy.

Plan demographics

Plan demographics

Filter participants by current employment status and age.

Participant-level data

Participant-level data

Click into a participant for more details, including current holdings, contribution sources, vesting progress, beneficiaries, and eligibility information.

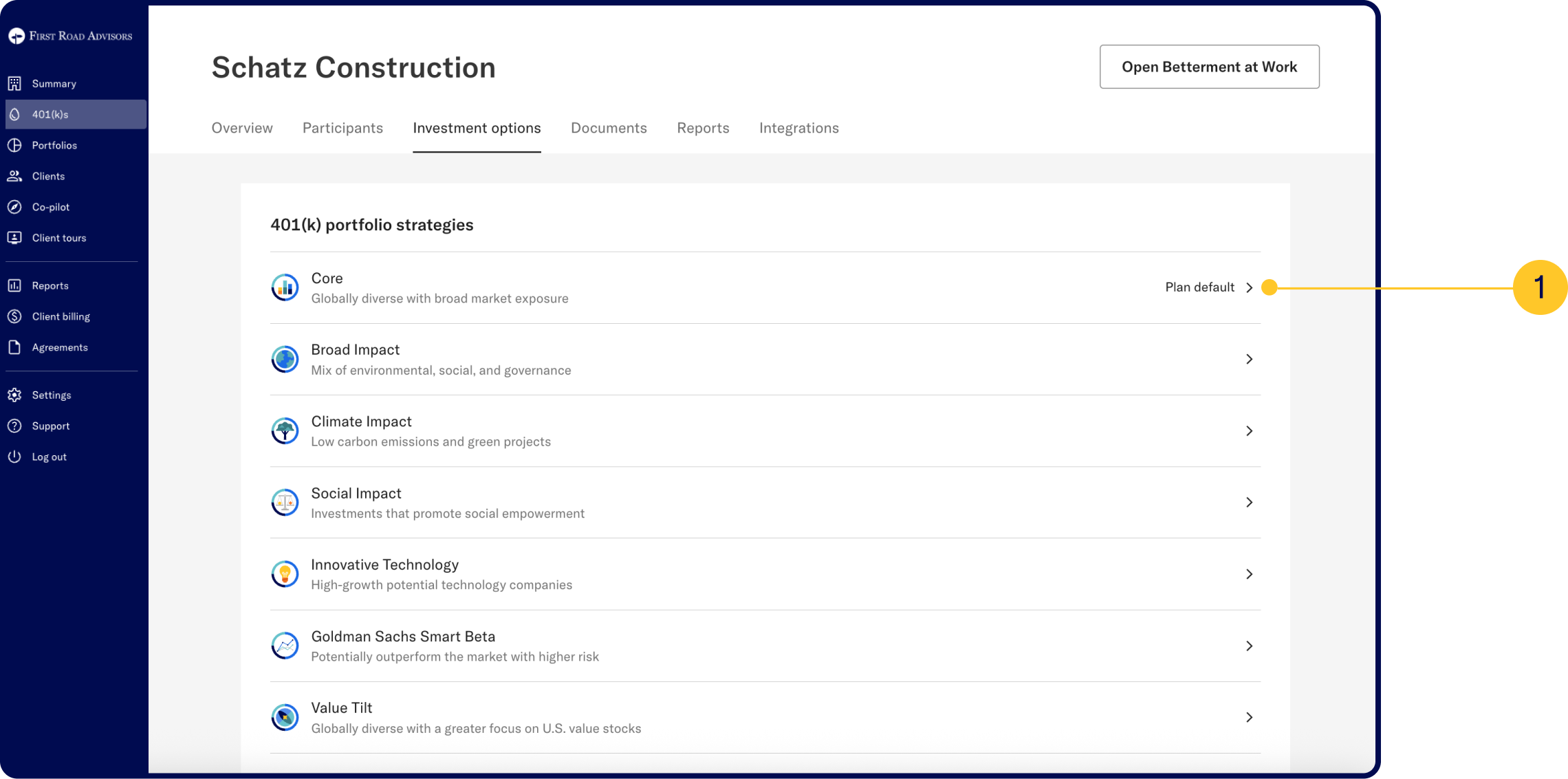

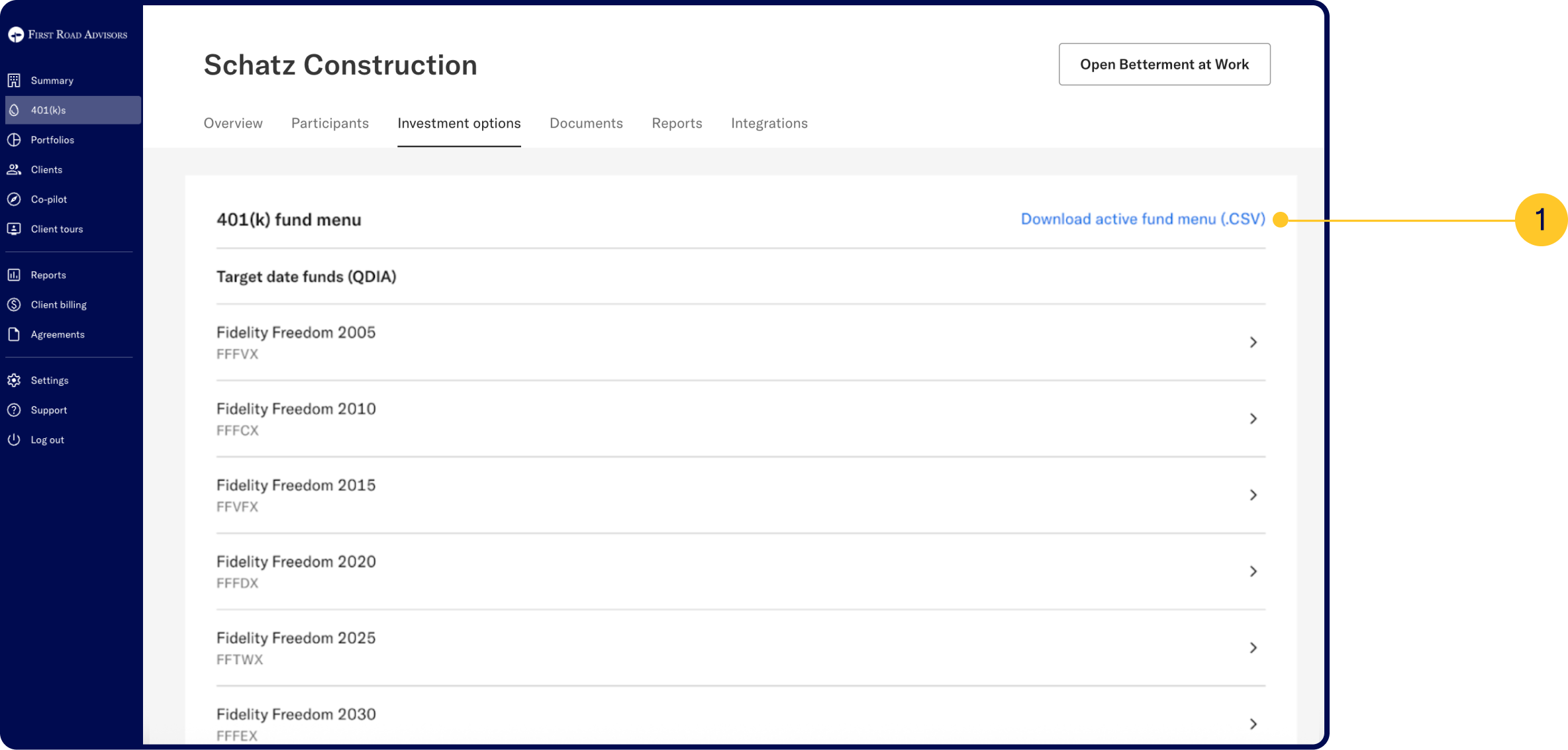

Plan Fund menu

Betterment holds the 3(38) role:

Betterment holds the 3(38) role:

Explore all available model portfolio strategies, with Core as the default QDIA. Drill down into a portfolio to see performance history, projections, and holdings based on sample allocations or risk profiles.

3(38) advisors:

3(38) advisors:

View the plan’s active fund menu, explore fund details—such as expense ratios, fund and benchmark performance—and access prospectuses. You can also download the full menu and data as a CSV file for easy reference.

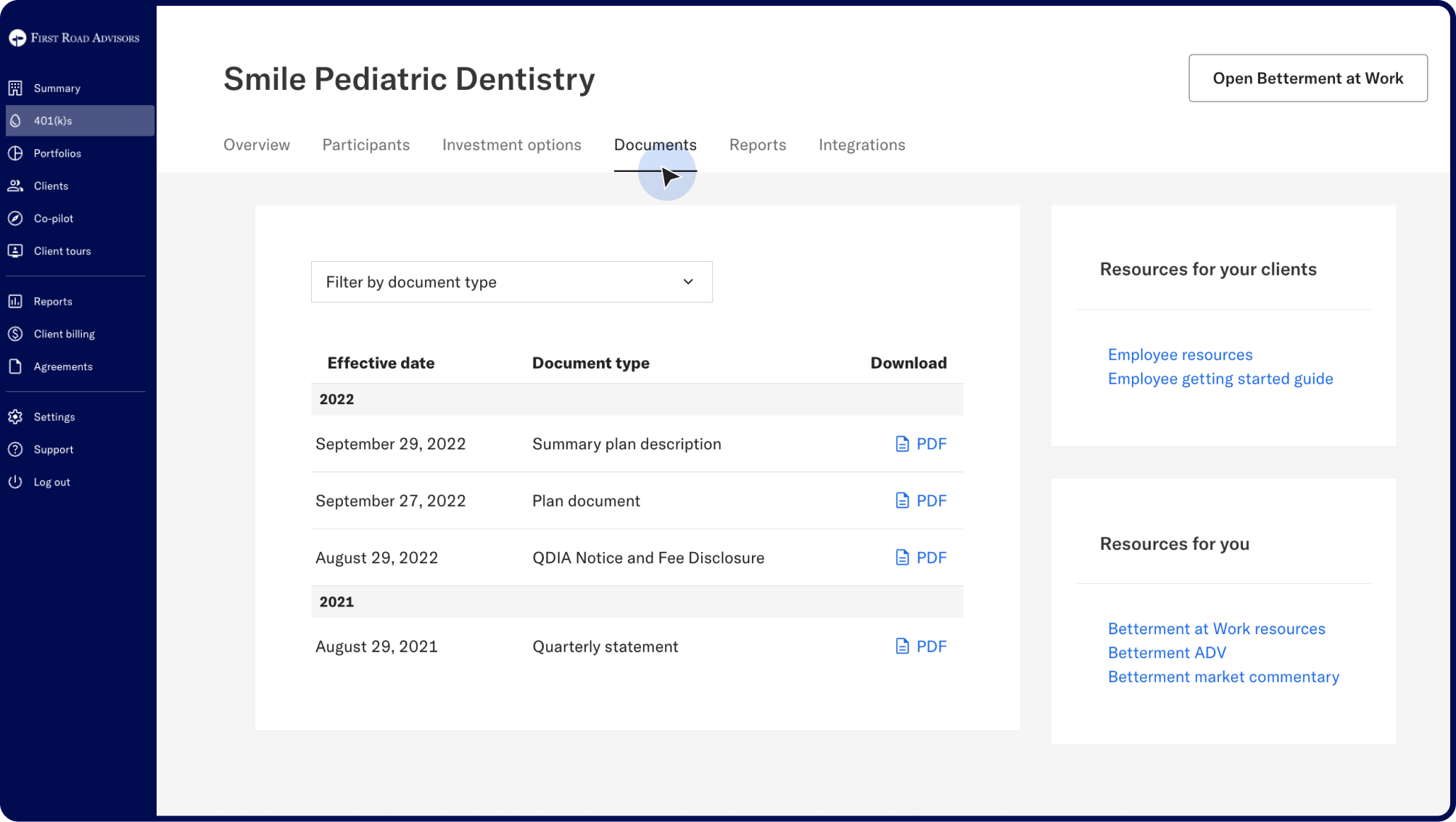

Plan Documents

Explore, filter, and generate PDFs for essential documents to stay organized and compliant.

Available documents include:

Summary plan description: Outlines the plan’s features, eligibility, and participant rights.

QDIA notice and fee disclosure: Provides important investment and fee information to participants.

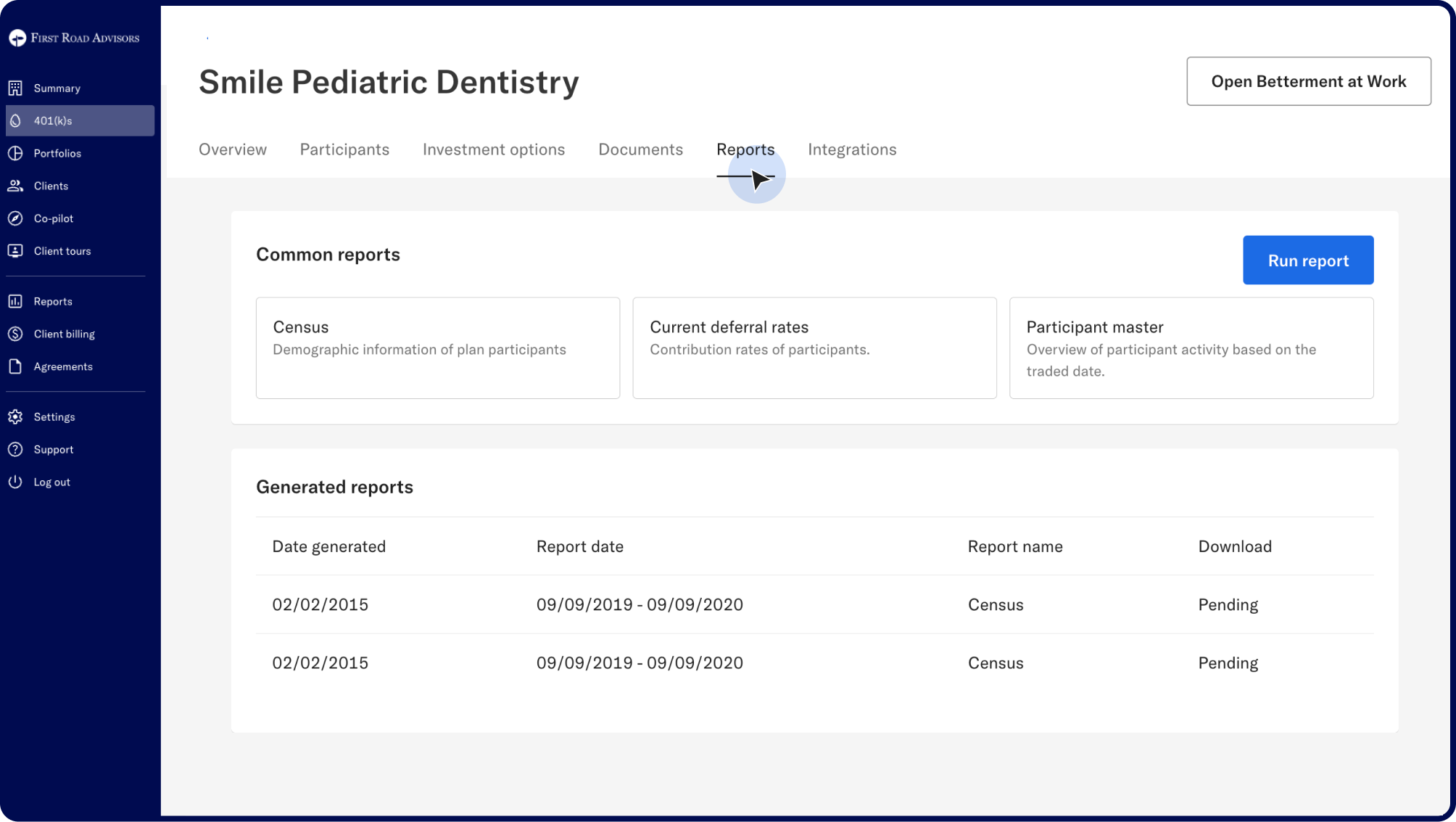

Reports

Types of reports available to run:

Participant & payroll reports:

- Census: Demographic and employment information of participants.

- Current Deferral Rates: Contribution rates of participants.

- Deferral History: Changes in deferral rates over time.

- Participant Activity: Balances by contribution source for a selected period.

- Participant Contributions (Individual): Log of each individual contribution.

- Participant Contributions (Total): Total payroll contributions by source.

- Participant Vesting: Vesting details by participant and contribution source.

Plan & investment reports:

- Plan Activity: Overview of plan activity by contribution source.

- Schedule of Assets: Overview of assets by ticker.

- Plan Contributions: Contributions into the plan by effective and trade dates.

- Plan Level Investment Activity: Total financial activity by fund ticker.

- Participant Level Investment Activity: Participant trading activity by ticker.

Funds & Accounts reports:

- Cash Fund: Activity in and out of the plan’s cash account.

- Forfeiture Fund: Activity in and out of the forfeiture account.

- Suspense Fund: Activity in and out of the suspense account.

- Unallocated Funds: Record of forfeiture, suspense, and cash fund totals.

Fees & Loans:

- Fee Detail: Vesting and fee data by participant and contribution source.

- Fee Summary: Total participant fees by type.

- Loans: Active participant loans.

- Loan Payments: Payments, payoffs, and conversions related to loans.

Administrative reports:

- Corrections: Log of corrective actions initiated.

- Distributions: Distributions processed for participants.

Get support you can count on

Contact your CSM today. Contact details are available in the Support tab of your Advisor Dashboard.