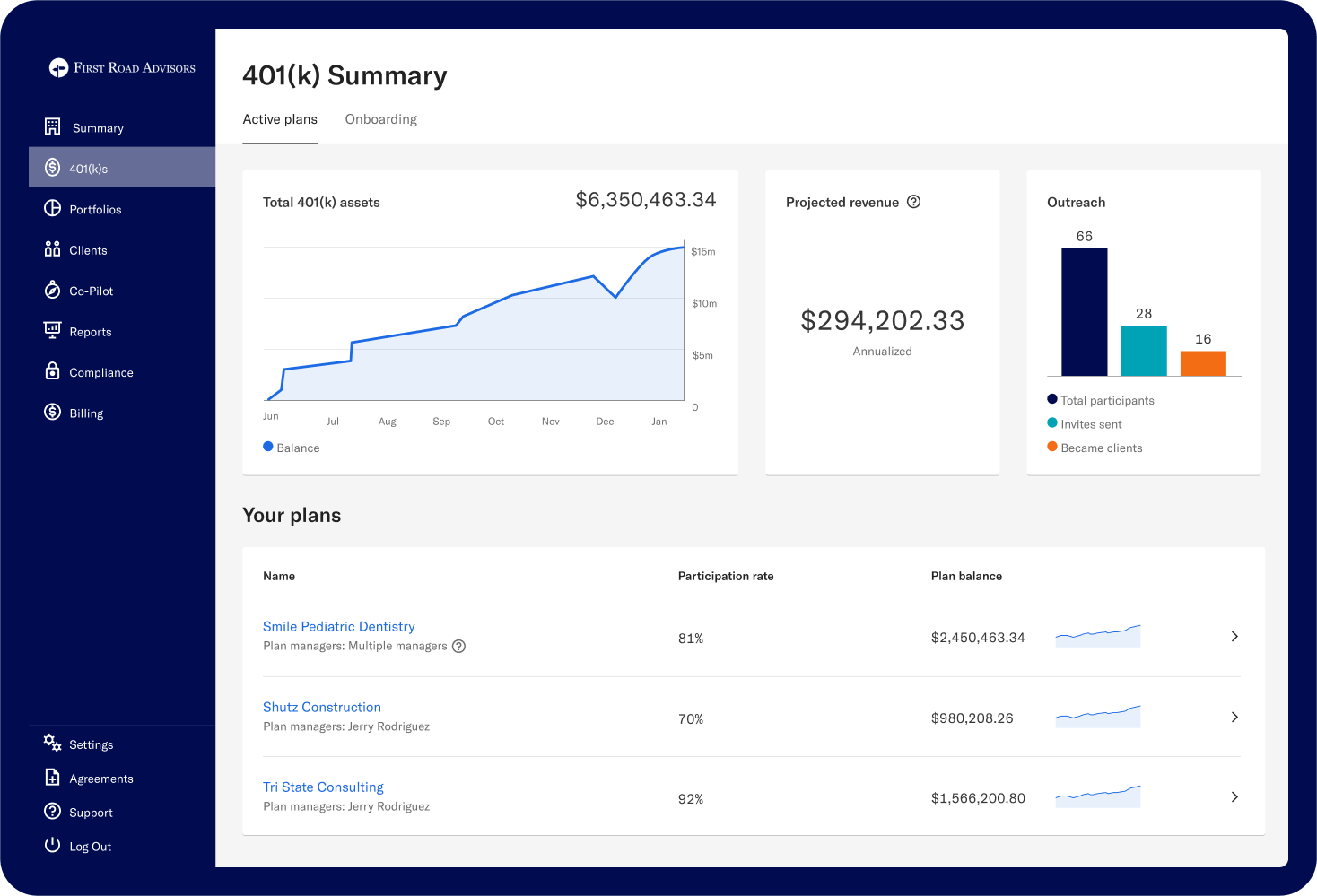

A 401(k) solution built for advisors

An easy-to-use platform with customizable investment options and white glove support for you and your clients.

- Flexible, customizable plan design and investment options

- Dedicated advisor support for administrative needs

- An all-in-one platform to service clients across retirement and wealth

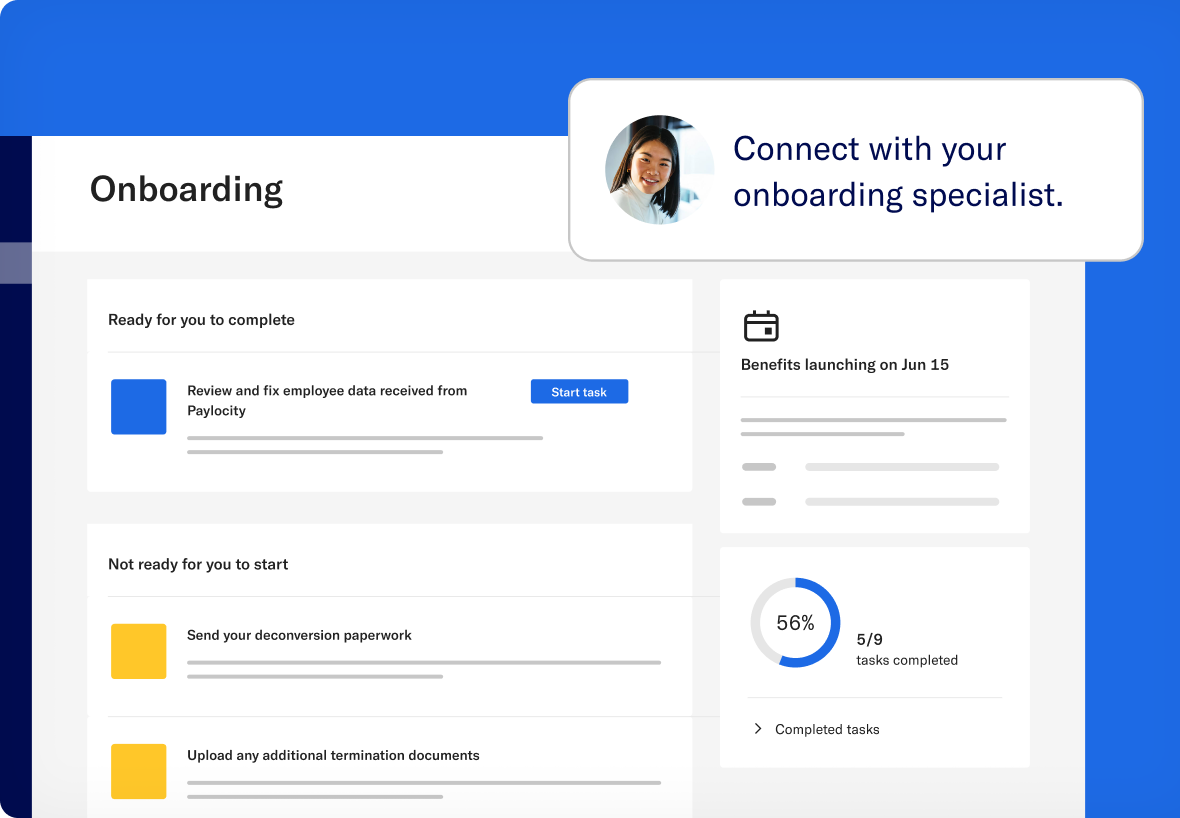

Image is hypothetical.

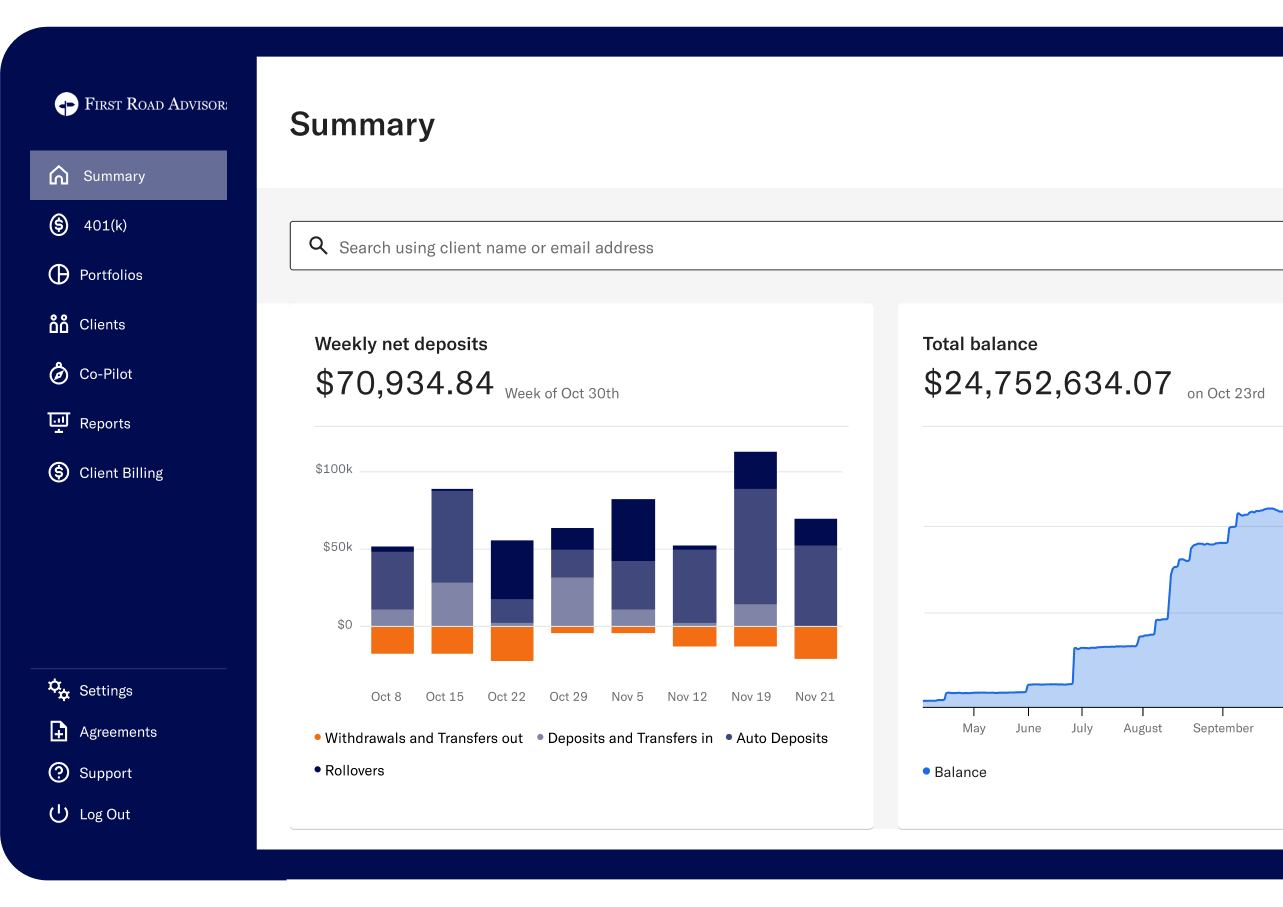

A turnkey 401(k) experience that’s better for you and your clients.

Combining your expertise with our easy, award-winning platform and customization capabilities.

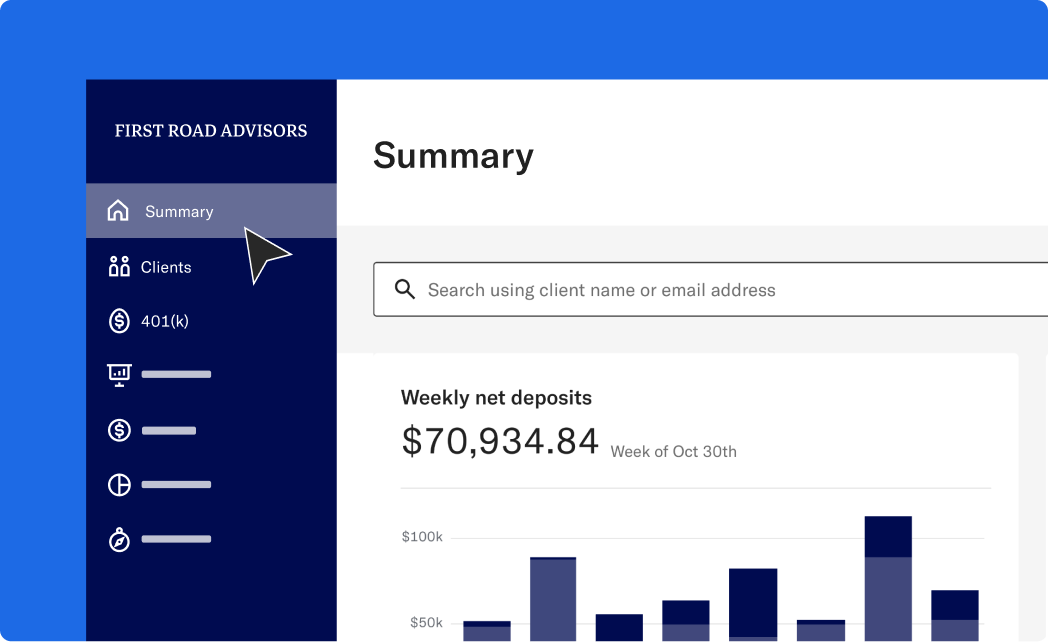

Track plan metrics, generate custom reports, and get participant-level data with just a few clicks.

Image is hypothetical

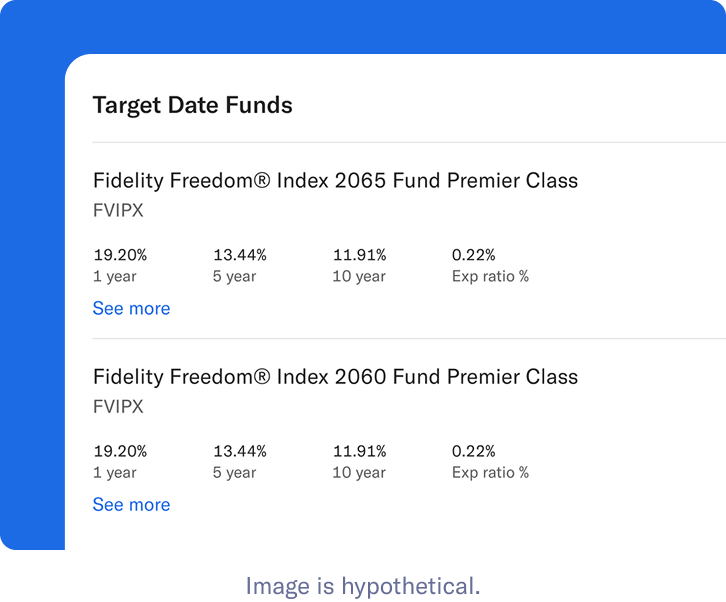

Build your own fund lineup on our open-architecture platform or outsource it to us. Our investment program is flexible to support you however you prefer to work.

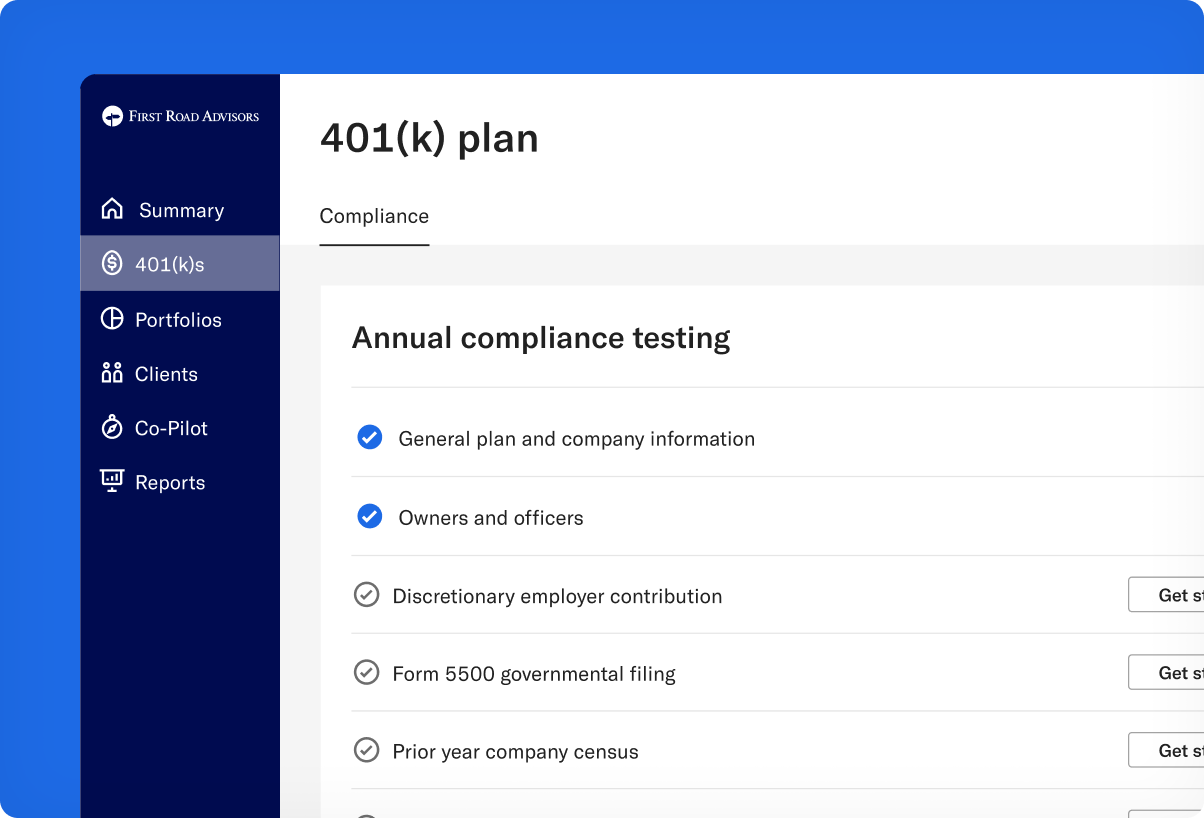

We are your 3(16) administrator, handling compliance testing, taking on time-intensive work, and preparing audit packages and 5500s.

Dedicated plan support and onboarding specialists that serve as an extension of your firm, so you can more efficiently serve clients.

"It's all automated. And I know that frees me up to do things that will add value to clients.”

Paul Sydlansky, Lake Road Advisors

Non-paid client of Betterment. Views may not be representative, see more reviews at the App Store and Google Play Store.

Non-paid client of Betterment. Views may not be representative, see more reviews at the App Store and Google Play Store.

An easy-to-manage and automated 401(k) for clients.

Provide simplified administration and operational support through a digital-first retirement plan.

-

Seamless payroll integrations

We connect with most payroll providers to largely automate plan administration. -

Employee engagement resources

A comprehensive program of webinars, emails, and more to reduce the burden on plan sponsors. -

Service and support

A dedicated onboarding specialist helps clients get started and provides ongoing support. -

Optional employee benefits

Go beyond the 401(k) with benefits to attract and retain top talent—from 401(k) match on student loan payments to 529s.

An all-in-one platform across retirement and wealth.

Leverage our tools and technology to easily convert participants to new clients. Build relationships and offer holistic financial planning to meet their evolving needs.

Image is hypothetical.